- August 24, 2025

- Posted by: Shane Daly

- Categories: Basic Trading Strategies, Trading Article

You’ve heard the age-old advice to “buy low and sell high,” but that may not always the best strategy. Momentum trading offers a different approach that can lead to more consistent profits. Instead of trying to catch market bottoms or tops, you’ll learn to identify and capitalize on existing trends. This powerful method combines technical analysis with strategic timing, and once you understand its core principles, you’ll see why many successful traders rely on momentum.

Video Highlights

- Focus on assets showing proven strength and established upward trends rather than attempting to catch falling prices.

- Use technical indicators like RSI to identify overbought and oversold conditions while confirming momentum patterns.

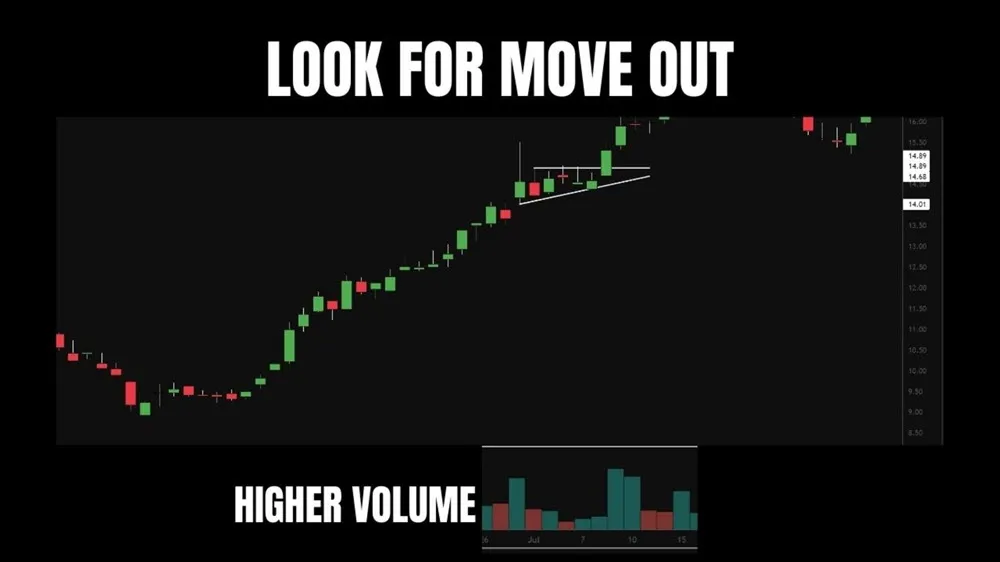

- Monitor consolidation patterns and volume spikes during support tests as signals for potential trend continuation.

- Implement strict risk management with clear entry points, exit strategies, and appropriate position sizing.

- Wait for price confirmation after consolidation periods and avoid chasing prices too high above support levels.

The Flaws in Traditional Trading Wisdom

While “buy low, sell high” has been the golden rule of trading for generations, this oversimplified advice often leads traders down the path of losing trades.

When you’re trying to catch falling prices, you’re essentially betting against the market’s momentum, which requires exceptional emotional resilience and risk tolerance. You might think you’re getting a bargain, but there’s often a reason why prices are dropping.

Instead of trying to predict the bottom, it’s smarter to focus on assets showing proven strength.

Successful traders understand that position sizing is one of the keys for managing risk exposure while pursuing momentum-based opportunities.

Understanding Market Momentum Dynamics

Market momentum isn’t just a buzzword – it’s a powerful force that can make or break your trading success. When you understand market psychology, you’ll see that momentum reflects genuine buying interest and institutional commitment.

It’s not about predicting the perfect bottom, but rather identifying and following established trends that you can easily see on the chart.

Your trend analysis should focus on assets showing clear upward movement followed by healthy consolidation. Think of momentum like a wave – you don’t want to fight against it because most times, you will lose..

Instead, learn to recognize its patterns and ride along. This approach puts probability on your side and helps minimize emotional trading decisions and guesswork.

Both technical and fundamental analysis play crucial roles in identifying and confirming momentum trends that align with market sentiment.

Key Components of Momentum Trading Strategy

Successful momentum trading relies on several core components that work together. You’ll need to master trend analysis to spot strong price movements and identify clear consolidation patterns. When you’re watching the markets, focus on assets showing sustained upward momentum rather than trying to catch falling prices.

Risk management is equally important – you shouldn’t risk more than you can afford to lose on any trade. Starting with the often quoted 1-2% risk is not a bad place to start.

Set clear entry and exit points, and always use stop-loss orders to protect your capital. Remember, it’s better to wait for confirmed momentum than to jump in too early.

The Relative Strength Index can help identify overbought and oversold conditions to confirm momentum trading signals.

Reading Price Action and Consolidation Patterns

Once you’ve identified a strong trend, you’ll need to master the art of reading price action and spotting consolidation patterns.

Watch for these key signals that show healthy price trends and potential breakout opportunities:

- Price starts moving sideways after a strong upward move

- Volume spikes appear during key support tests

- Price stays above major moving averages during consolidation

- Smaller price swings develop with decreasing volatility

When you see these patterns forming, it’s often a sign that the asset is gathering strength for its next move.

Don’t rush – wait for clear confirmation before entering your trade. The best setups usually show a tight consolidation followed by increasing volume as price starts to move.

Optimal Entry Points for Maximum Returns

While finding the perfect entry point might seem challenging, you’ll maximize your returns by focusing on specific price levels after consolidation.

Watch for clear entry signals when prices break above the consolidation range with increased volume. This confirms renewed buying interest and reduces your risk.

Your risk management strategy should include waiting for a pullback to the breakout level before entering if looking to be more conservative with an entry. Keep in mind that the pullback may never come and that is the price you pay for that confirmation.

Don’t chase prices too high above consolidation – patience is key. Instead, look for steady price movement and strong volume patterns that show institutional support.

These indicators will help you make more confident trading decisions.

Round number support often creates natural price reversal points where buying pressure increases significantly.

Building Your Momentum Trading Framework

After mastering entry points, you’ll need a complete framework to put momentum trading into action.

Understanding market psychology and momentum indicators will help you build a strong system that works consistently in various market conditions.

- Start by tracking key momentum indicators like RSI and MACD to confirm price movements.

- Learn to read market psychology through volume and price action patterns.

- Create a checklist of specific conditions that must align before entering trades.

- Develop clear rules for position sizing and risk management based on volatility.

Your Questions Answered

How Long Should I Hold Positions When Trading With Momentum Strategies?

Your holding period depends on how the momentum plays out after your entry timing.

Watch for signs of weakening momentum like decreased volume or breaks below key support levels.

You’ll want to exit when the upward trend loses steam or shows reversal signals.

Don’t try to time the exact top – it’s better to secure profits when momentum slows than risk giving back gains.

What Percentage of My Portfolio Should I Allocate to Momentum Trades?

You should limit your momentum trades to 10-20% of your total portfolio for effective risk management.

Don’t put all your eggs in one basket – focus on portfolio diversification by spreading your investments across different strategies and assets.

If you’re new to momentum trading, start with just 5% and gradually increase as you gain experience and confidence in your trading abilities.

Which Technical Indicators Best Complement Momentum Trading Strategies?

You’ll find the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) particularly useful for momentum trading.

These trend strength indicators help confirm market direction and potential reversals. Add the Average Directional Index (ADX) to measure trend strength, and Bollinger Bands to spot consolidation periods.

When these indicators align with price action, they’ll give you stronger confirmation for your momentum trading decisions.

How Do Earnings Reports and Company News Affect Momentum Trading Decisions?

You’ll want to pay close attention to earnings reports and news as they can create significant price swings in either direction.

News volatility often disrupts existing momentum patterns, while earnings impact can strengthen or reverse trends instantly.

It’s smart to reduce your position size or stay out of trades entirely before major announcements.

Once the market digests the news, you can reassess the momentum pattern and adjust your strategy accordingly.

When Should I Cut Losses Versus Allowing a Momentum Trade Time?

You should cut losses when a trade drops below your predetermined loss thresholds, typically 5-7% from your entry point.

Don’t let emotions override your exit strategy.

For trade duration, give momentum trades time to develop as long as they’re holding above key support levels and maintaining their upward trend.

If the price action becomes choppy or volume drops significantly, that’s your cue to exit.