- January 27, 2025

- Posted by: Shane Daly

- Category: Trading Article

Mastering the Relative Strength Index (RSI) can transform your trading approach. This versatile momentum indicator offers far more than simple overbought and oversold signals – it’s a sophisticated tool that can reveal hidden market dynamics and potential trend reversals.

While many traders stick to the default 14-period setting, understanding how to customize and interpret RSI across different timeframes and market conditions will give you a significant edge. Let’s explore the advanced techniques that separate successful RSI traders from the rest.

TLDR

- Customize RSI period settings based on your timeframe: 5-7 for short-term, 14 for medium-term, and 21-28 for long-term trading.

- Combine RSI with other indicators like MACD and Moving Averages to confirm signals and reduce false positives.

- Master divergence analysis by identifying when price and RSI move in opposite directions to spot potential trend reversals.

- Place stop-loss orders below swing lows for bullish trades and above swing highs for bearish trades.

- Avoid relying solely on overbought/oversold levels, as strong trends can maintain these conditions for extended periods.

Optimal RSI Settings for Every Trading Timeframe

While many traders default to the standard 14-period RSI setting, the prime timeframe varies significantly based on your trading style and market conditions.

Understanding the best RSI setting for different trading timeframes can make a big difference in your trading success.

For short-term trading on 1-minute to 15-minute charts, you’ll want to use a shorter 5 to 7-period RSI setting. This helps you catch quick price movements and is perfect if you’re a day trader or scalper.

When you’re trading on medium-term timeframes like 30-minute or 1-hour charts, stick with the traditional 14-period RSI. It’s proven effective and gives you a good balance between signal sensitivity and noise reduction.

If you’re focusing on longer-term trades using 4-hour or daily charts, you’ll benefit from extending your RSI setting to 21 or 28 periods. This longer setting helps you filter out market noise and identify genuine trend changes.

Remember to look for divergence patterns when analyzing RSI across any timeframe, as they can provide reliable signals for potential market reversals.

Combining RSI with Powerful Technical Indicators

You’ll find that combining RSI with other technical indicators can help confirm trading signals and reduce the chances of making mistakes in your trades.

When you pair RSI with popular indicators like Moving Averages, MACD, Bollinger Bands, Stochastic Oscillator, or Volume analysis, you’re creating a more complete picture of market conditions and potential trade opportunities.

Each combination serves a unique purpose – for example, RSI with Moving Averages can help identify trend direction while RSI with Bollinger Bands can spotlight potential reversal points, making your trading decisions more reliable.

The price action confirmation alongside RSI readings is essential for determining the most effective entry points and avoiding false signals.

RSI and Moving Averages

The combination of RSI with moving averages creates a powerful duo for technical analysis. When you’re looking to confirm trends and spot potential trading opportunities, these two indicators work together to provide clearer signals. The RSI helps identify overbought conditions while moving averages strengthen your trend identification abilities.

You’ll want to start by watching for crossovers between your short-term and long-term moving averages. When the 10-day moving average crosses above the 50-day line, that’s your first bullish signal. Then, check the RSI – if it’s reading above 50, you’ve got a stronger confirmation of an upward trend.

The opposite is true for bearish signals: a downward crossover paired with an RSI below 50 suggests a downward trend might be forming.

This dual approach helps filter out false signals. For example, if you see a bullish moving average crossover but the RSI is showing weakness below 50, you might want to wait for additional confirmation before entering a trade.

RSI and MACD

Combining RSI with MACD creates one of the most reliable technical analysis frameworks for confirming trade signals. When you’re looking to improve your rsi trading strategies, pairing these two indicators can help you spot genuine trend changes while filtering out false signals.

The MACD’s crossovers become more meaningful when confirmed by RSI readings, giving you a clearer picture of market momentum.

To effectively use this combination, watch for MACD crossovers above the signal line while the RSI moves above 40. This dual confirmation suggests stronger upward momentum.

Similarly, when the MACD crosses below its signal line and the RSI falls under 60, you’ve got a potential sell signal worth considering.

- You’ll feel more confident in your trades knowing you have two powerful indicators backing your decisions

- You’ll experience less stress from false signals that could drain your trading account

- You’ll gain a deeper understanding of market momentum that goes beyond basic price action

- You’ll develop a more systematic approach to trading that removes emotional bias

RSI and Bollinger Bands

While MACD provides valuable momentum observations, pairing RSI with Bollinger Bands adds another powerful dimension to your technical analysis toolkit. When you combine these two indicators, you’ll get more reliable trading signals that can help confirm your market decisions.

The real power of this combination lies in how it helps you identify potential reversals. When you see the price touch or break through the upper Bollinger Band while the RSI reads above 70, you’ve got a possible sell signal on your hands. Think of it as the market telling you it’s getting overheated.

On the flip side, when prices hit the lower band and your RSI drops below 30, you’re looking at oversold conditions – this could be your buy signal.

Here’s what makes this combo work: Bollinger Bands show you market volatility through their expanding and contracting bands, while RSI confirms whether the market’s really overextended. You’re essentially getting two different perspectives on price action, making your analysis more thorough and your trading decisions more informed.

RSI and Stochastic Oscillator

Another powerful pairing in technical analysis comes from using RSI alongside the Stochastic Oscillator.

When you combine these two momentum indicators, you’ll get stronger trading signals confirmation and a clearer picture of market momentum. The Stochastic Oscillator helps you understand price momentum by comparing closing prices to a range over time, while RSI measures the speed and magnitude of price changes. Together, they create a more complete view of market conditions.

- You’ll feel more confident in your trading decisions when both indicators confirm each other.

- You’ll experience less stress knowing you have double confirmation before entering trades.

- You’ll gain deeper insight into market psychology through divergence patterns.

- You’ll reduce the risk of false signals by using two complementary indicators.

Looking for divergences between RSI and price action, while also monitoring the Stochastic Oscillator, can help you spot potential market reversals early.

For instance, if prices are making new highs but both indicators show lower highs, that’s a strong signal that momentum might be weakening. This combined approach helps you make more informed trading decisions based on multiple confirmations rather than relying on a single indicator.

RSI and Volume

Volume analysis serves as a great companion to RSI signals, helping traders validate price movements and spot potential market reversals. When you’re analyzing RSI calculations, adding volume to your toolkit can significantly improve your trading decisions by confirming the strength of market trends.

You’ll want to pay attention to how volume behaves alongside RSI readings. When you see high volume accompanying price increases, it’s often a sign of strong buyer interest.

However, if you notice the RSI showing overbought conditions while volume starts dropping, this could be your cue that the upward momentum is weakening. This combination might signal an upcoming reversal.

The opposite scenario is just as important to watch. When the RSI indicates oversold conditions and you see volume picking up, it could present a solid buying opportunity.

This pattern suggests that more traders are stepping in to buy at lower prices. Remember to use volume analysis as a confirmation tool rather than relying solely on RSI signals. By combining these two indicators, you’re adding an extra layer of validation to your trading strategy.

Master RSI Divergence Trading Strategies Now

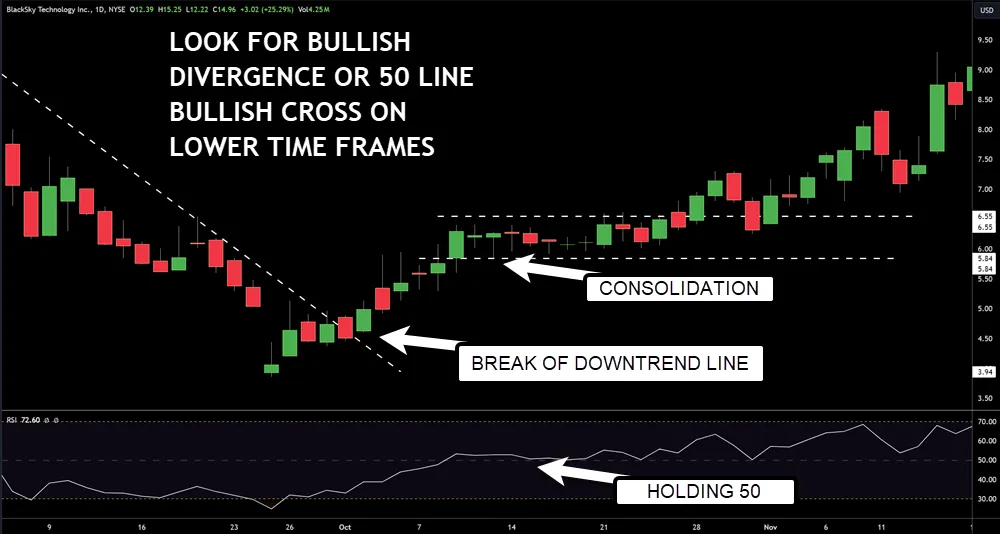

To spot powerful trading opportunities using RSI divergence, look for situations where price and RSI move in opposite directions, such as when price makes higher highs while RSI makes lower highs (bearish divergence) or vice versa (bullish divergence).

You can strengthen your RSI divergence signals by checking multiple timeframes and making sure the overall trend supports your trade direction.

For the best results, you’ll need to confirm your divergence trades with volume analysis and set clear stop-loss and take-profit levels to manage your risk effectively.

Day traders often find success using 5-period RSI settings when searching for divergence signals in volatile market conditions.

Identifying Bullish and Bearish Divergence

You’ll spot a bullish divergence when prices make lower lows, but your RSI shows higher lows – this often signals that sellers are losing steam and buyers might take control soon.

On the flip side, bearish divergence appears when prices hit higher highs while the RSI forms lower highs, suggesting the upward momentum is weakening.

As you dive deeper into technical analysis, you’ll find that divergence patterns can be your early warning system for potential trend changes. Always remember to look for confirming signals before making your trading decisions.

- Feel confident knowing you’re catching momentum shifts before most traders

- Transform your frustration with missed opportunities into actionable observations

- Take control of your trading by spotting reversals early

- Experience the satisfaction of making data-driven trading decisions

Remember to combine RSI divergence with other technical indicators and price action for the most reliable signals.

This approach isn’t just about spotting patterns – it’s about understanding the story behind price movements and making informed trading decisions.

Combining RSI Divergence with Trend Analysis

Building on your understanding of RSI divergence, let’s explore how combining it with trend analysis creates a more resilient trading approach.

When you spot RSI divergence, you’ll want to consider the overall market trends before making trading decisions. This combination helps you make smarter choices and reduces the risk of false signals.

| Market Condition | Trading Strategy |

|---|---|

| Uptrend + Bullish Divergence | Strong buy signal – trend likely to continue |

| Uptrend + Bearish Divergence | Caution – potential reversal or consolidation |

| Downtrend + Bullish Divergence | Possible trend reversal – watch for confirmation |

| Downtrend + Bearish Divergence | Strong sell signal – trend likely to continue |

| Sideways + Any Divergence | Wait for clear trend direction before trading |

To use this strategy effectively, you’ll first need to identify the prevailing market trend. Once you’ve done that, look for RSI divergence patterns that align with the trend. For example, if you’re in an uptrend and spot a bullish divergence, it’s often a stronger signal than finding the same divergence in a downtrend. This method helps you filter out weaker signals and focus on high-probability trades.

Multi-Timeframe Analysis

While single-timeframe analysis provides valuable perspectives, examining RSI divergence across multiple timeframes offers a more comprehensive view of the market.

You’ll want to start by analyzing larger timeframes to understand the overall trend, then move to smaller ones for precise entry points. When you spot a divergence on your primary timeframe, check if higher and lower timeframes support your analysis.

Multi-timeframe analysis helps you avoid false signals and strengthens your trading decisions. For instance, if you notice a bullish divergence on a daily chart but see bearish momentum on the hourly timeframe, you might want to wait for confirmation before entering a trade.

This approach to market analysis significantly reduces your risk exposure and improves your success rate.

- Feel the confidence that comes from knowing you’re seeing the complete market picture

- Experience the peace of mind of making well-informed trading decisions

- Enjoy the satisfaction of catching major trend reversals early

- Welcome the security of having multiple confirmation points before trading

Always align your trades with the dominant trend across timeframes, and don’t rush into positions without proper confirmation.

Volume Confirmation

Volume analysis serves as a powerful confirmation tool when trading RSI divergences, helping you validate potential trend reversals and market shifts. When you’re looking at RSI signals, paying attention to volume can make a significant difference in your trading decisions.

Think of volume as a way to measure the strength behind price movements – it’s like checking how many people agree with the market’s direction.

Here’s how you can use volume to strengthen your RSI analysis: When you spot a bullish divergence (where price makes lower lows while RSI makes higher lows), check if the volume is increasing. If it is, that’s a stronger signal that buyers are stepping in and the upward move is more likely to happen.

On the flip side, if you see a bearish divergence with declining volume, you might want to be cautious. Lower volume during bearish moves could mean there’s not enough selling pressure to sustain the downward trend.

Setting Stop-Loss and Take-Profit Levels

To maximize your success with RSI divergence trading, proper stop-loss and take-profit placement is essential. When you’re trading bullish divergence, place your stop-loss orders just below the recent swing low to protect your position.

For bearish divergence trades, set your stop-loss right above the swing high. This strategy helps you manage risk while giving your trades enough room to breathe.

Take-profit levels should align with previously established support and resistance zones. These areas often act as natural price barriers and can provide logical exit points for your trades. By identifying these levels beforehand, you’ll have a clear plan for securing profits and won’t be tempted to let emotions drive your decisions.

- Feel confident knowing your risk is properly managed from the start

- Experience peace of mind with predetermined exit points

- Stay disciplined and avoid emotional trading decisions

- Build consistency in your trading approach

Remember that successful RSI divergence trading isn’t just about spotting the pattern – it’s about protecting your capital and maximizing your returns through smart risk management. Your stop-loss orders and take-profit levels are your safety net, helping you stay in the game for the long run.

Adapting RSI for Different Market Conditions

Successfully adjusting RSI settings requires understanding how different market conditions and asset classes respond to various timeframes and parameters.

When you’re trading in highly volatile markets, you’ll want to use shorter RSI periods between 5 and 9 to catch quick momentum shifts. In contrast, calmer markets work better with longer periods of 14 to 21, which help filter out market noise.

Your choice of asset class should also influence your RSI settings.

- If you’re trading stocks, the standard 14-period RSI usually works well, but you might adjust to 9 or 21 periods depending on the stock’s behavior.

- For forex trading, where prices can move rapidly, shorter settings between 5 and 10 periods can help you stay responsive to market changes.

- Cryptocurrency traders often find success with 7 to 14 period settings due to the market’s inherent volatility.

Remember that your trading timeframe matters too.

- If you’re day trading, stick to shorter periods of 5 to 10 to capture quick moves.

- For longer-term trading strategies, opt for extended periods of 14 to 28 to identify significant trends while avoiding minor fluctuations.

Pay special attention when RSI signals align with exhaustion gaps, as these combinations often indicate potential market turning points.

Critical Mistakes to Avoid with RSI

While mastering RSI settings improves your trading strategy, understanding common mistakes can protect your investments. One of the most common issues is relying only on RSI without considering other market factors. You’ll want to combine RSI with other technical indicators and fundamental analysis for better-informed decisions.

Many traders fall into the trap of misinterpreting overbought and oversold levels. Remember, an RSI above 70 doesn’t automatically mean “sell,” just as readings below 30 don’t always signal “buy.” Strong trends can maintain these levels for extended periods, so consider the broader market context.

- You might miss vital reversal signals if you’re not watching for RSI divergence from price action.

- Your trading account could suffer from overtrading if you jump at every RSI signal without confirmation.

- You risk substantial losses by using default settings without adapting them to specific market conditions.

- Your analysis might be incomplete if you’re not combining RSI with other technical indicators.

Don’t forget to validate RSI signals with additional confirmation methods, like candlestick patterns or trend lines. This multi-layered approach helps reduce false signals and improves your trading accuracy.

Using RSI to Predict Trend Reversals

Identifying trend reversals with the RSI indicator requires a strategic approach that combines multiple signals and confirmations. You’ll want to focus on two key RSI levels:

- readings above 70 suggest overbought conditions

- readings below 30 indicate oversold conditions.

These levels can help you spot potential price changes before they happen.

To make reliable trading decisions, you’ll need to watch for divergence patterns. When you see the price making lower lows but the RSI showing higher lows, that’s bullish divergence – a signal that an upward reversal might be coming.

The opposite scenario, where prices make higher highs while the RSI forms lower highs, suggests bearish divergence and a possible downward reversal.

Don’t rely on the RSI alone. You can strengthen your analysis by combining RSI signals with other indicators like moving averages. For example, if you spot an oversold RSI reading that lines up with a strong support level and a bullish candlestick pattern, you’ve got a more reliable signal.

Remember to protect your trades by setting clear stop-loss levels and taking profits at predetermined points. Consider pairing RSI with MACD divergence signals to eliminate low-probability trades and enhance your overall trading accuracy.

RSI’s Role in Smart Risk Management

When you’re planning your trades, you can use RSI readings to determine appropriate stop-loss levels and adjust your position sizes based on signal strength.

For example, if RSI shows a strong oversold condition below 30, you might consider a larger position size for a long trade, while maintaining strict stop-loss levels to protect your capital.

Your risk management strategy becomes more resilient when you combine RSI with other technical indicators. You’ll want to avoid false signals by confirming RSI readings with support and resistance levels or trend lines.

For position sizing, you can adjust your trade size based on how extreme the RSI readings are.

- Your confidence grows when you know exactly when to scale in or out of positions

- You’ll sleep better at night knowing your risk is properly managed

- You can trade with peace of mind using proven RSI-based stop-loss strategies

- You’ll feel more in control of your trading decisions with systematic position sizing

A recommended approach is to use Average True Range for more precise stop-loss placement and improved risk assessment in your trading plan.

Your Questions Answered

Can RSI Be Effectively Used for Cryptocurrency Trading?

You can effectively use RSI for crypto trading, but you’ll need to combine it with other indicators and adjust your settings for crypto’s higher volatility and 24/7 trading environment.

Why Do Some Traders Prefer RSI Over the Stochastic Oscillator?

You’ll find RSI more reliable as it focuses on closing prices rather than high-low ranges. It’s less prone to whipsaws and provides clearer signals in trending markets than the Stochastic oscillator.

How Accurate Is RSI in Predicting Price Movements During High-Volatility Periods?

During high volatility, you’ll find RSI’s accuracy decreases as rapid price swings can trigger false signals. It’s best to combine RSI with other indicators for more reliable trading decisions.

Does RSI Work Better in Trending Markets or Ranging Markets?

You’ll find RSI performs better in ranging markets where clear overbought and oversold levels are established. In trending markets, RSI can give false signals as prices continue pushing beyond typical thresholds.

What’s the Significance of RSI Crossing the Centerline at 50?

When RSI crosses above 50, it signals bullish momentum and potential uptrend continuation. When it drops below 50, you’ll see bearish momentum taking control and possible downtrend continuation.