- August 9, 2019

- Posted by: Mark S

- Categories: Advanced Trading Strategies, Trading Article

There are many types of trader personalities but I want to focus on two specific types.

Both of these types have the potential to be successful as a trader only if they are able to get out of their own way.

You may find yourself as one of these types and if you are still struggling to succeed, perhaps will find the solutions presented as an open door invitation to get yourself right.

The Shiny Object Trader

The shiny object trader (SOT) is the one who wants to explore and experiment with anything new that pops onto the trading scene.

They fear that they are missing a cog in the wheel that will lead them to success as a trader.

Every new trading system or trading indicator has them extremely interested as they love finding out about different approaches traders can take.

Look, there is nothing wrong with having a healthy interest in these types of things.

There’s a point thought where it becomes detrimental to a trader.

- It’s good to have a broad understanding of how different market players are trading

- It’s good to have the ability to select effective parts of these alternative approaches to bolster your own trading strategy

- It’s good to recognize how markets shift over time and how some methods break down over time while some experience a greater degree of success

But the SOT will have a tough time finding success in trading (depending on their definition of success).

There’s a distinct danger that with each new shiny object, rather than it adding to their knowledge and experience, it becomes the sole focus of their efforts.

The problem is also that not every trading system available has a true edge in the market.

Even the trading methods that do have an edge, that edge has been eroded over time. The edges are smaller in the markets of today.

Here are two questions you should ask yourself about your current trading strategy:

- What is the edge I am trying to exploit in this market?

- If X happens, why should Y happen after?

A trader will have the best of intentions but will often times simply jump to another method (and they will have to prove that has an edge) and that takes time. This is assuming that traders actually back-test any trading method they are considering.

During that time, the losses pile up as this trader tests/trades this system. What happens next?

The trader has their eye out for the next shiny object that is going to pave their road to trading riches.

Stick To One Trading Edge

If you are this type of trader who can’t resist new and exciting systems and indicators and quickly moves on to the next, it’s time to step back and think how much effort you should really be putting into this part of trading.

There are many different traders who make money using differing methods and there are many different traders who lose money using differing methods.

- Trading pullbacks has a statistical edge in the market

- Breakout trading can work if you have a method of determining a higher probability of the break than the failure

- Even using moving averages, combined with other variables, can help you find success

The fact is that you may already be trading with an edge but are not willing to give it time to prove itself out.

Our advice?

Find a method and then work with it until you have enough information to understand whether it works or not in terms of really being an edge.

And if you still get all excited by investigating new ideas and indicators, have at it. Being on a constant quest to expand your trading knowledge is a good thing.

But instead of dropping your current method, figure out if there’s anything that you can borrow from the new technique in order to support how you already trade.

Quest For Perfection From Fear Of Failure

So what is it that drives this sort of behavior in certain traders?

Why are many unable to work with what is right in front of them?

The fear of failure.

They believe that it’s possible to make it as a trader and to think otherwise would be a betrayal of reality as they know it to be.

These are the people who will doubt the success of anybody else.

They haven’t found anything which they have been able to make successful.

As they use a system, they find flaws that they didn’t initially see that makes it less appealing.

The fear of failure means that any level of concern about an approach forces them to explore alternatives as failure is simply not an option.

- They want only the best

- They believe that success is possible and the rush of excitement and optimism when they find a new technique masks their doubts about their ability to succeed

- They don’t want to fail

- They don’t want to face their own psychological demons

They’re looking for immediate results and they often skip over things like psychology and money management in favor of finding a trading solution which makes them money.

But a system or indicator is just one part of long-term successful trading.

A trading system that has an edge is not the only key you need.

So whatever the strategy, unless an individual is willing to get their hands dirty with the less glamorous side of trading, they will likely never achieve consistent success.

It is imperative that you have to change your trading mindset.

Take Your Trading Losses As You Do Your Wins

You must first realize that by the very nature of trading, every trader will take regular losses.

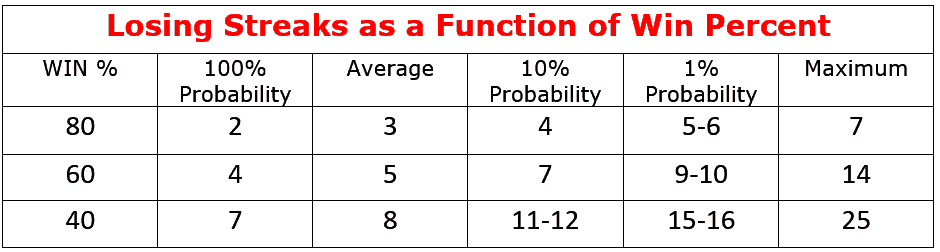

Often times you will have a string of losing trades as shown in this chart:

Understand that you have no way of being certain when those losses will come.

The importance of being true to the execution of a trading strategy and trade plan with a proven trading edge is essential to your success.

You must trust your trading system and therefore your trading edge to truly find the success you desire.

This is what trading day to day is about – not changing your approach as you go along.

The trouble is that people don’t see this from successful traders and trading system developers.

Why would they?

Most trading systems aren’t sold on the merits of how effectively they take their losses are they?

But it’s these kinds of details that have the potential to determine the success of a system in the live markets.

Trading statistics about things such as success by time of day, trading errors and how a market moves subsequent to your exit can have a huge impact on the level of performance of a strategy.

The issue with statistics is that without a well-planned trading journal, this data either becomes so time consuming to gather, that a trader won’t want to tackle it or it is lost entirely.

There are price patterns that have an edge in the market. Learn how to use them in my

FREE Price Pattern Trading Guide to help improve your trading results.

You can download the Free guide here.