- April 5, 2024

- Posted by: CoachShane

- Categories: Basic Trading Strategies, Trading Article, Trading Tutorials

Have you ever wondered how you can practice trading strategies in the stock market without risking your hard-earned money? To start paper trading effectively, begin by learning about the basics. Consider a reliable platform like TD Ameritrade (Tradestation) or E-Trade for a lifelike market simulation. Practice using the trading interface, set up your virtual account with a similar cash amount that you will be using, and experiment with different strategies.

Learn how to use technical analysis tools, monitor your performance, and control your emotions for disciplined trading. Keep track of your progress, analyze metrics that make your trading strategy work, and avoid common mistakes that are made by a lot of traders.

Transition to real trading by evaluating your simulated results and building confidence in execution. Look into advanced techniques such as short selling and options trading to improve your skills.

How to Start Paper Trading Effectively

When you start paper trading effectively, make sure you understand the basics. Choose a reputable platform, create your account, and explore the trading interface so you can operate it with your eyes closed.

Introduction to Paper Trading

To start paper trading effectively, first, understand the concept and set clear goals for your virtual trading experience. Paper trading provides numerous benefits, including:

- Risk-Free Learning: Experiment with different trading strategies without facing real financial risks.

- Platform Familiarization: Get to know the trading platform’s features and tools thoroughly.

- Strategy Development: Improve your trading methods by practicing and analyzing your performance.

- Market Simulation: Gain insights into market dynamics within a controlled setting with no risk.

Choosing the Right Paper Trading Platform

Consider well-known brokers like TD Ameritrade, E-Trade, or Interactive Brokers when choosing a paper trading platform for virtual trading. Look for platforms that provide real-time market data to accurately simulate trading conditions. Select a platform with a user-friendly interface that suits your trading style and preferences. Also consider looking for platforms that offer educational resources, tutorials, and reliable customer support.

Testing different platforms before making a decision can help you find the one that best meets your paper trading needs. Confirm that the platform’s features and trading conditions align with your requirements for your strategy. Take the time to explore various options to discover the platform that suits you and your trading strategy the best.

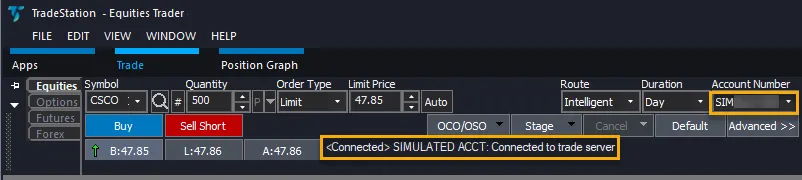

Setting Up Your Paper Trading Account

When you’re setting up your paper trading account, make sure to choose a brokerage platform that offers paper trading. Here are some key points to consider:

- Ensure you have access to real-time market data and a range of trading tools for a more realistic experience.

- Practice placing trades, setting stop-loss orders, and monitoring your virtual portfolio to familiarize yourself with the platform.

- Begin with a virtual cash amount that matches your actual trading capital to simulate accurately.

- Regularly use the paper trading account to test various strategies, evaluate performance, and improve your trading skills before transitioning to live trading.

Getting Familiar with the Trading Interface

Get to know the order entry system for precise buy and sell orders. Use technical analysis tools like charts, indicators, and drawing tools on the trading platform. Practice setting stop-loss orders to manage risk efficiently. Keep an eye on your portfolio, monitor performance, and analyze trade history to enhance decision-making. Learn to dig into research tools on the platform to stay updated on stocks and market trends.

Get to know the order entry system for precise buy and sell orders. Use technical analysis tools like charts, indicators, and drawing tools on the trading platform. Practice setting stop-loss orders to manage risk efficiently. Keep an eye on your portfolio, monitor performance, and analyze trade history to enhance decision-making. Learn to dig into research tools on the platform to stay updated on stocks and market trends.

Developing and Testing Trading Strategies

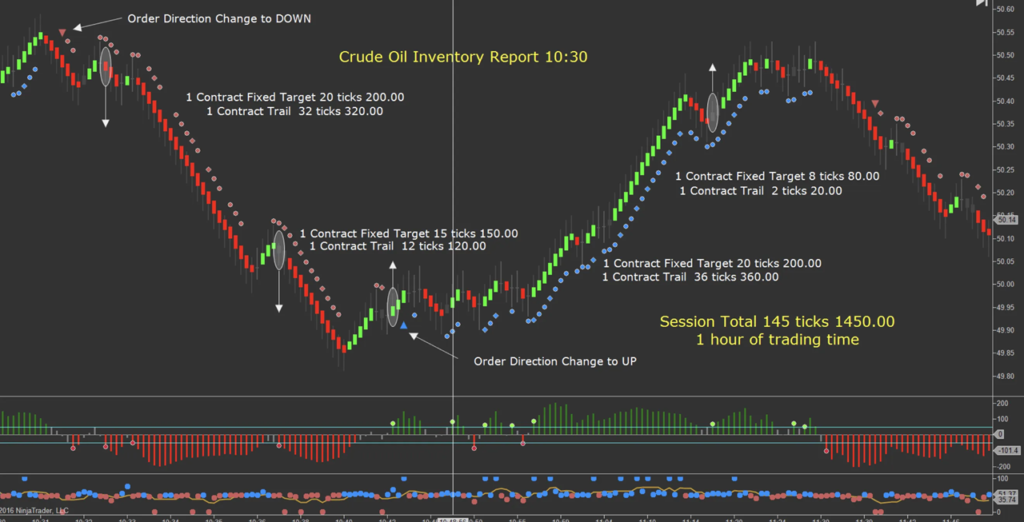

To start paper trading effectively, first, define clear goals aligned with your trading objectives and strategies. When developing and testing trading strategies, remember to:

- Test different trading strategies using historical or real-time data to evaluate their effectiveness.

- Establish strict risk parameters and simulate real trading conditions to build discipline.

- Solicit feedback from trading educators or mentors to enhance your paper trading strategies.

- Maintain a detailed trading journal to monitor your progress, learn from errors, and refine your approach.

Understanding the Role of Emotions in Trading

Understanding how emotions impact your trading decisions is important for starting paper trading effectively. Emotions such as fear and greed can lead to impulsive decisions, which can affect the outcomes of your trades.

Managing these emotional challenges is essential for successful paper trading. By developing techniques to handle your emotions and practicing mindfulness, you can improve your trading performance.

Identifying emotional triggers can help you maintain discipline and focus on your trading strategies, avoiding biases that may cloud your judgment. Traders with emotional intelligence can stick to their plans and handle the market’s fluctuations with a clear mindset and confidence.

Establishing a solid foundation in trading psychology and discipline is vital for overcoming emotional obstacles and achieving success in paper trading.

Tracking and Analyzing Your Performance

Start keeping track and analyzing how you’re doing in your paper trading. Keep a detailed trading journal to note down important trade details. Use important metrics like win rate, average profit/loss per trade, maximum drawdown, and risk-reward ratio to analyze your performance.

Make use of trading software that includes features like profit/loss graphs, trade history logs, and trade analysis tools to help you track your performance better. Look for patterns in your trade history to identify your strengths and weaknesses, so you can adjust your strategies and get better over time.

Reflect regularly on your trading performance to learn from your mistakes, celebrate your wins, and make decisions that can improve your future trades. By maintaining a trading journal and analyzing key metrics, you can monitor your progress and make better decisions to improve your paper trading skills.

Avoiding Common Pitfalls in Paper Trading

As you start paper trading, it’s important to avoid common pitfalls that can slow down your progress and skill development. Establish clear risk parameters to mirror real trading conditions and keep clear of unrealistic expectations that generally lead to disappointment.

Maintain a trading journal to monitor your advancement, learn from errors, and enhance your strategies. Experiment with various trading techniques in simulated market scenarios to improve your skills effectively.

Understand and adjust to the simulated market environment to expand your expertise in trading and your strategy. Consult with trading educators for insights and feedback that may be able to elevate your trading performance. By sidestepping these pitfalls and adopting these practices, you can refine your strategies and evolve into a more successful trader over time.

Transitioning from Paper Trading to Real Trading

Transitioning from paper trading to real trading involves gradually introducing actual money into your trades while sticking to disciplined trading strategies. Consider these key points as you make the shift:

- Review Your Trading Record: Look back at your simulated trading results to pinpoint your strengths and areas for improvement.

- Manage Drawdowns: Be ready for potential losses by understanding drawdowns and effectively controlling risks.

- Build Confidence: Use your successful simulated trading experiences to boost your confidence when you start live trading.

- Understand Market Dynamics: Stay informed about market trends and dynamics to make well-informed decisions in real trading.

Advanced Paper Trading Techniques

To take your paper trading skills to a more advanced level, consider using techniques like short selling and options trading to mimic real market conditions effectively.

Margin trading can also boost your gains and losses, giving you a more realistic trading experience.

Use advanced charting tools and technical indicators to analyze the market, helping you make educated trading decisions. Use risk management strategies such as setting stop-loss orders and managing your position sizes to protect your investments.

Experiment with different trading approaches like intraday and swing trading to see how they impact your portfolio performance. Participating in simulated trading competitions can also help you improve your decision-making skills under pressure.

| Advanced Trading Techniques | Explanation | Advantages |

|---|---|---|

| Short Selling | Betting on stock price drops | Profiting in declining markets |

| Options Trading | Trading based on contracts | Leveraging and managing risk |

| Margin Trading | Using borrowed funds for trades | Amplifying gains and losses |

Conclusion

Paper trading is a useful tool for new traders to practice and refine their strategies without risking real money. By following the steps outlined in this guide, you can start paper trading effectively and build the confidence needed to succeed in the financial markets.

Remember to be disciplined, monitor your progress, and learn from your mistakes to continuously enhance your trading skills.

FAQ

How can I begin practicing with a paper trading account?

To start paper trading, you’ll need to open a simulated trading account with a broker or trading platform that offers this feature. Many brokers provide paper trading accounts, also known as practice or demo accounts, which allow you to trade with virtual money in a risk-free environment. This lets you familiarize yourself with the trading platform, test strategies, and gain experience without risking real capital.

Can paper trading generate actual profits?

No, paper trading does not generate real profits or losses. It is a simulated trading environment where you trade with virtual money, allowing you to practice and learn without financial risk. The primary purpose of paper trading is to gain experience and test strategies before transitioning to live trading with real capital.

What is the recommended approach for a beginner to start trading?

For beginners, it is highly recommended to start with paper trading or a demo account before risking real money. This allows you to learn the mechanics of trading, understand the platform, and develop a strategy without the emotional and financial stress of live trading. Once you have gained sufficient experience and confidence through paper trading, you can consider transitioning to a live, funded account.

Is it advisable for a novice trader to begin with paper trading?

Yes, paper trading is strongly recommended for novice traders before they start trading with real money. It provides a risk-free environment to learn, practice, and refine trading strategies without the potential for financial losses. Paper trading allows beginners to make mistakes and learn from them without facing the consequences of losing capital.

How long should I practice with a paper trading account before using real money?

There is no definitive timeframe, as the duration of paper trading depends on the individual’s learning curve, commitment, and progress. However, it is generally recommended to paper trade for at least several months, or until you consistently generate profits and feel confident in your trading abilities. The goal is to develop a proven strategy and gain enough experience to manage risk effectively before transitioning to live trading.

Is paper trading an accurate representation of real market conditions?

Paper trading accounts attempt to simulate real market conditions as closely as possible, but there are some limitations. While the price data and order execution are typically based on live market feeds, paper trading accounts may not account for factors such as slippage, commissions, and the psychological impact of risking real money. However, paper trading still provides a valuable learning experience and a close approximation of live trading conditions.