- January 11, 2019

- Posted by: Shane Daly

- Categories: Basic Trading Strategies, Forex Trading

Forex trading software has evolved from simple broker charts and Forex trading robots all the way to Forex automation software that make it easy for anybody to enter the market and begin trading

Markets of all types have benefited from technology advances and the number of advancements in online trading can boggle the mind but we can break them down into the following categories:

- Automated Forex Trading Software: These often use algorithmic trading strategies to execute trades without your intervention.

- Trading Platforms. These include the popular free Metatrader 4, paid packages such as Tradestation and of course the Forex charts that come from your chosen broker.

- Forex Trading Signals: Buy and sell recommendations from a signal provider.

Let’s break down each section and then wrap up with the attributes that you may want to consider when determining the best trading software for yourself.

Automated Forex Trading Software

Auto trading systems come with controversy. Many large firms use automated trading systems to enter and exit their positions but this is not the same type of automatic trading that is available to the average trader.

Keep in mind that these companies have millions of dollars they use for the design of their automatic trading software. They recruit the best minds with a wide range of expertise from top schools to research the markets and write the code. This code then optimizes itself over time depending on the recent past performance of the market.

Forex trading robots (expert advisors) attempted to capitalize on the success of automation however in the end, they have shown themselves to be a waste of money, a waste of time, and a quick end to trading accounts.

Automated Forex trading robots are, for the most part, using over optimized technical analysis tools for trading decisions that fit past data and use tell you when to buy and sell.

Try using a robot on a demo account instead of a real account and you will see that the hype generally never equals reality.

The controversy doesn’t end with trading robots.

High frequency trading software (HFT) has caused many issues with the markets prompting the SEC to begin an investigation. Exchanges are being looked at for potentially giving HFT traders an advantage over other traders in relation to the buy/sell orders.

It’s not all doom and gloom as there are Forex automated trading software programs that are designed by those who have a profitable trading system. They have simply chosen to automate their work and can allow a program to execute when their trading variables line up.

Benefits of Automated Trading

Letting a software program determine your trading opportunities and even executing when a buy or sell signal appears has a few positives that may interest a Forex trader:

Eliminate Emotional Mistakes

If you have traded for a while, you may have noticed the urge to do some things outside of your trading plan. These usually occur either after a losing trade(s) or after a string of winners where you feel invincible.

Once the variables line up, the trade is executed and managed without your intervention. With your buy or sell signal being executed by the auto trading aspect of the software, you don’t have the fear of missing out on a trade.

The trade is allowed to play out to its conclusion and the win/loss becomes a random distribution of the method and not from your deviation of the trading plan.

Allows Traders To Be Consistent

Without allowing your judgement to come into play for your trading decisions, each trade is executed exactly as outlined in the trade plan. You allow the expectancy of your trading system to play out and if the expectancy is positive, you know in the long run, your trading software will serve up a healthy trading account for you.

Allows Multiple Trading Opportunities

When your automated Forex trading software is unleashed on a wide range of currency pairs, you will be hard pressed to miss a trading opportunity. Since Forex traders are looking to enter currency trades virtually around the clock, you can be assured that your automated trading software is waiting for trading opportunities regardless of the time of day.

There is a drawback however and that is being over exposed in the market. Trading software usually has a limit on the amount of capital exposure but if your does not, expect to find yourself in too many positions and in many cases, being long and short and just compounding losses.

Risk management is vital so you can reap the rewards of successful trades without blowing your trading account when the losing trades come.

Design Your Own Automated Trading Software Program

Not all Forex traders can code but if you can, this will allow traders to take their own successful trading strategy and automate it to either execute a trade or to send you a signal. There are also coders you can find on the web that may assist you with developing your automated program or you can learn it yourself

Let’s consider a simple trend following trading system for your automated Forex trading system that uses a moving average technical indicator for market sentiment and to enter/exit a trade

Your coding could simply include:

- 200 period SMA

- Enter when price closes above 200 SMA

- Exit when price closes below 200 SMA

- Risk management includes percentage of trading account

You would write the code for the strategy and run a back test to determine if the variables you have chosen had success in the past. The danger is over-optimizing the trading variables and while the automation looks promising, the future results are not as exciting.

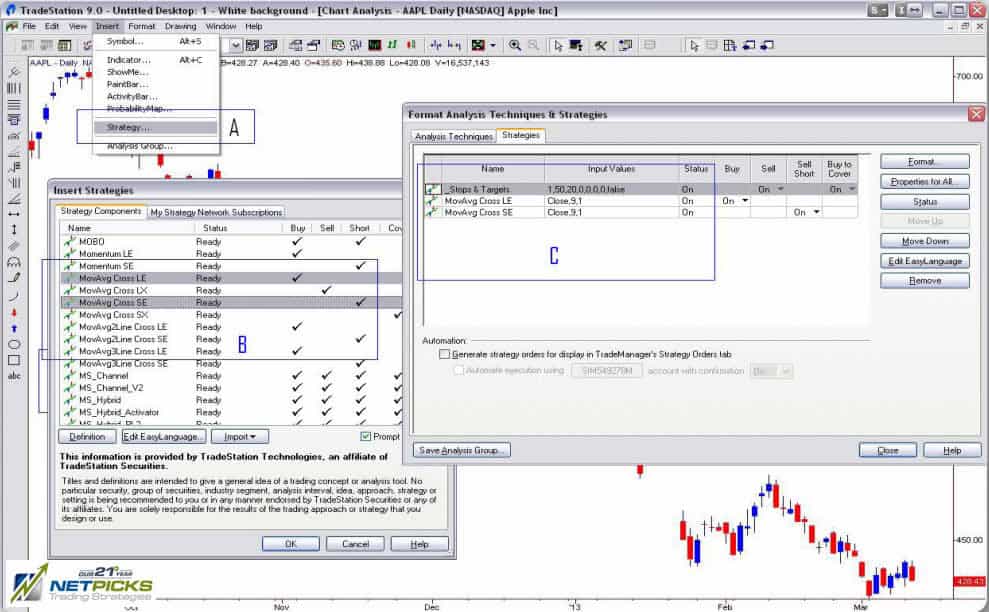

You can watch this video for an example of a moving average crossover automated trading system and learn a little about custom programming. You can also read this article about building an automated trading strategy with Tradestation.

In essence, you start with an idea to develop a trading strategy you want to automate, learn to write the code, and then back test to see if the past data shows any promise.

Forex Charting Software

These are the currency charts where price is plotted and in some instances, you can enter and exit trades right from the charts (on-chart trading). Trading chart software can go from basic price and time plots to a whole range of information such as:

- Economic calendars

- Market profile

- Pattern recognition tools

- Chart multiple pairs and markets

- Market depth

- Watch lists

- Portfolio managers

The features available depend on a few variables however keep in mind that the more features, can mean a higher price for the charting software.

Many people, especially beginners in currency trading, would probably want the following features in the forex trading platforms they may be considering:

Various Technical Analysis Indicators

Since many begin their trading education by learning about technical analysis, indicators such as moving averages, oscillators and other trend determination tools may be useful.

Most platforms, including the free Metatrader download that is available even for mobile trading, comes with a vast array of technical analysis tools that may make up your particular trading system. Metatrader range bars are also available.

On Chart Information

I find this useful because knowing at a glance where price is in relation to your stops or targets in real time make trade management extremely simple.

Some charting software programs will allow you, with a click of the mouse on the chart itself, to execute your trades without a separate piece of trading software.

You can also easily adjust your stops if trailing or adjust your take profit targets by simply pulling a horizontal line up or down on the chart itself.

Free Forex charting software from your trading broker does have drawbacks.

The market data feed usually comes direct from your broker and not an arms length third party. Since Forex is not a centralized exchange, there may be different price quotes between brokers.

As well, software such as Metatrader provided to you from your broker usually has a wider spread value so in reality, it truly is not “free”.

Downloading your trading software is not the only option.

You can also get online Forex charts and one popular type are the charts from Trading View. These are not as sophisticated as the paid download platforms and may not be suitable for all investors and traders but for a simple trading style, they may be all you need.

Another benefit is there is a social trading aspect that comes with Trading View. This enables traders to see what other traders are considering when they look at the charts. You can post your own thoughts and get comments on your charts.

This is a good trading for beginners tool that allows them to see if they are having the same thought process as other traders.

Forex Trading Signals

This type of Forex trading software is different from the automated trading software described above. These provide you with Forex signals for entry and exit levels and you are responsible in the execution.

Trading signal software can also encompass trading systems that you are available on the internet and this is a route some take to start trading.

This trading software allows you to trade currency using a a combination of variables and trade plans. Here are the general steps in swing and day trading software once you download from the vendor.

- Unpack the various indicators and templates

- Install those items in the folders appropriate for you charting software

- Apply the template to your charts

The key to this type of software for the foreign exchange trader is to ensure you back test the plan according to the trade plan that accompanies the system.

The benefits to the back test include:

- Testing your knowledge of the system

- Proving to yourself the system gives you an edge

- Train yourself to execute the system when appropriate according the trading plan

If you are new to this type of Forex software, you can see the benefits by downloading the free version of Netpicks own Trend Jumper. Simply download, install, and back test the system

How to Start Forex Trading with Software

Every trader is unique and some things will suit you while for another, it may not be appropriate. There is nothing better than trial and error and that is often the best way to learn. It would be prudent for you to download any Forex trading software you are considering and put it through your own style of testing.

There are a few points that each person should investigate during their testing phase.

Is Support Attentive?

There is nothing worse than trying to work through something yet not have the support to help you over the humps. If support is not existent now, don’t expect them to be there when you have real money on the line. Be a stickler for proper support.

What Is The Refund Policy?

To be fair, there are many low quality companies out there selling low quality products. Ensure there is a refund policy and make sure you read the fine print to make sure you fulfill the refund requirements.

That said, be a quality individual who doesn’t simply refund to get the trading software for free. If you are requesting the refund in good faith and there is no response, charge-back through your credit card company.

Does The Product Fit The Hype?

Forex is one of the most hyped markets and many vendors with promote their Forex trading software with outlandish claims. Make sure that what they promise, they deliver. While results may differ, they should not be so far off the mark if you have followed the instruction they laid out. Forex robots were hyped to be an ATM but most, if not all, failed to deliver. Remember if it is too good to be true, it probably is.