- January 8, 2025

- Posted by: Mark S

- Categories: Day Trading, Trading Article

Emini daytrading can be a lucrative venture if approached with the right strategies and mindset.

You can even qualify for a zero risk funded account and never risk your own capital due to new breakthroughs from select trader brokers.

The secret hack?

In order to qualify, you need a day trading system that works, generates profits and controls risk.

In this post, we will look into effective systems such as the High Velocity Wave Trader (HVWT) system, active setups, and the Trend Trader approach. Whether you are a novice or an experienced trader, understanding these concepts can enhance your trading experience and outcomes and ultimately qualify for zero risk trading accounts.

Understanding the HVWT System

The HVWT (High Velocity Wave Trader) system is designed to capture order flow that enters the market right at the open. This system is particularly useful for traders looking to maximize their opportunities during the early trading hours. It emphasizes the importance of having a clear set of rules to guide trading decisions.

Key Rules of the HVWT System

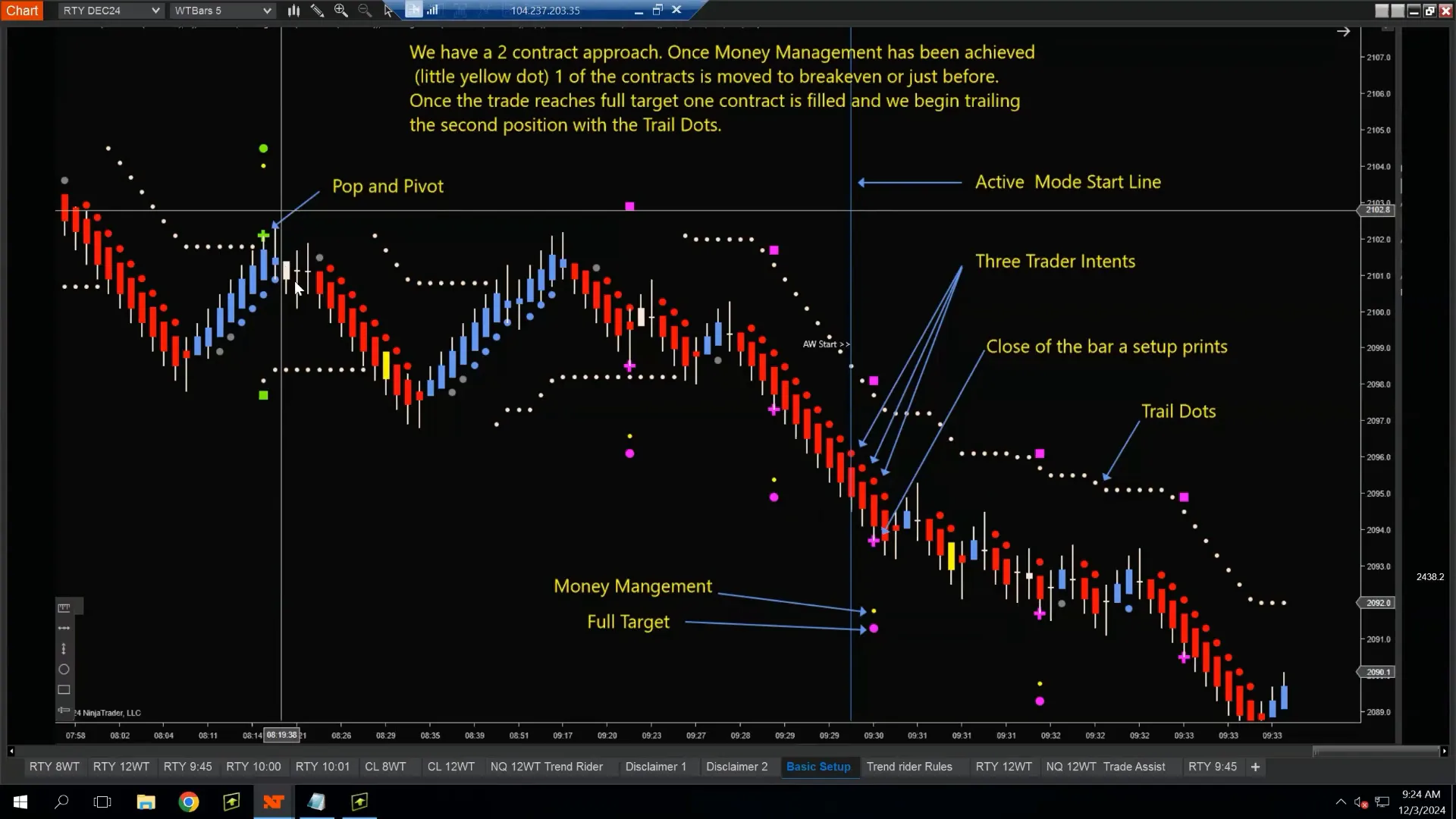

- Setup Timing: At 9:30 AM, a blue vertical line will appear on your chart, marking the beginning of your trading window.

- Trader Intent Indicator: This tool helps you match the bar color. You need three matches in sequence to confirm a setup.

- Entry Points: When a setup occurs, the calculator plots a plus sign indicating your entry point, complemented by a yellow dot for money management.

- Target Management: The ultimate target is represented by a blue dot, while additional positions are indicated by squares.

Once you reach the fixed target, the system activates a trailing stop, indicated by white dots, to help lock in profits as the trade progresses.

Active Setups: Timing is Everything

Active setups are important for maximizing trading opportunities. The primary trading window starts at 9:30 AM, but there are additional opportunities at 9:45 AM and 10:00 AM. Understanding how to react to price movements during these times can significantly impact your trading success.

Managing Price Movements

As a trader, it’s essential to avoid impulsive reactions to price movements. Instead of jumping into trades immediately, consider placing a buy stop above any hesitation in price. This allows you to wait for confirmation before entering a trade, minimizing the risk of losses.

If the price rolls over before triggering your buy stop, it’s known as a virtual stop-out, which means you avoided a losing trade.

If triggered, manage the trade according to your setup rules.

Analyzing Price Action: Session Highs and Lows

Understanding session highs and lows helps you identify key pivot points. Observing these levels can guide your trading decisions, especially during slower price action periods.

Using Pivots Effectively

Pivots are critical in evaluating price action. Once a pivot is broken, it’s essential to discard it and focus on new areas of interest on the chart. This practice helps you stay adaptable and responsive to market changes.

Transitioning to Trend Mode

After executing up to two active setups, HVWT traders transition to Trend mode. This phase often involves using the Trend Trader approach, which focuses on identifying and capitalizing on ongoing price movements.

The Trend Trader Approach

The Trend Trader method emphasizes movement. Traders need to identify when price is moving and act accordingly. A lightning bolt pattern, characterized by impulse moves followed by shallow pullbacks, is ideal for entering trades.

Here are the core rules for the Trend Rider strategy:

- Identifying Movement: Look for a sustained 15-bar move in one direction to establish a trend.

- Pullbacks: The shallower the pullback, the better. This indicates strong momentum and a higher likelihood of continuation.

- Pivot Points: Enter trades based on the pivot set by the impulse move, ensuring no significant resistance from session highs or lows.

Trading Windows: Optimal Times to Trade

Knowing the best times to trade can enhance your chances of success. Here are the optimal trading windows:

- London Session: 3 AM

- US Pre-Market: 7 AM

- US Open: 9:30 to 11:30 AM

- Afternoon Session: 12:50 to 1:50 PM

Be cautious around 3 PM when market trends typically slow down.

Risk Management Strategies

Effective risk management is essential in trading. Consider these strategies:

- Trail Stops: Use trailing stops to protect profits while allowing for potential further gains.

- Position Sizing: Adjust your position size based on market conditions and your overall risk tolerance.

- Psychological Preparedness: Be mentally ready for the ups and downs of trading. Managing emotions is just as crucial as managing trades.

Conclusion

Mastering emini daytrading requires a combination of effective strategies, timely decision-making, and sound risk management. By applying the principles discussed here, you can enhance your trading skills and potentially increase your profitability.

Where can I learn more about day trading systems?

For more insights and updates on the day trading system: https://www.getnetpicks.com/0425hvwtviplist