- December 30, 2024

- Posted by: Shane Daly

- Categories: Day Trading, Trading Article

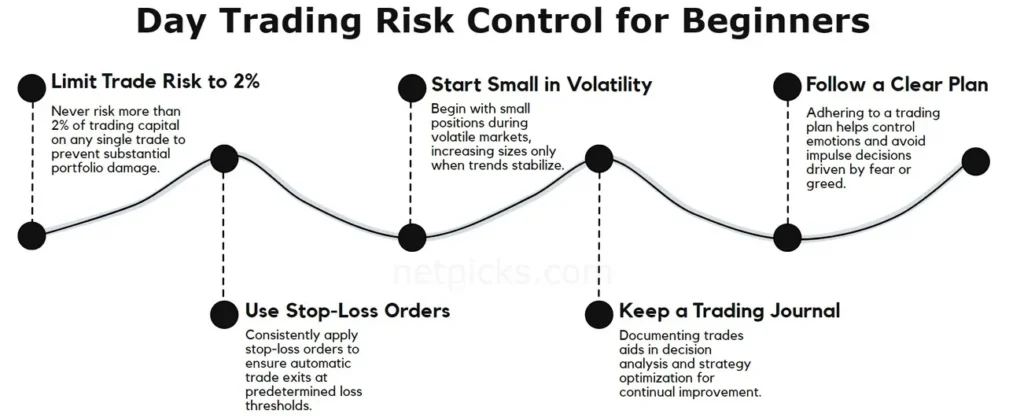

If you’re thinking about day trading, you’ll find that managing risk isn’t just an option – it’s essential for survival in the markets. You’re stepping into an career where even experienced traders can lose substantial amounts within minutes, and as a beginner, you’re particularly vulnerable to common mistakes that can drain your trading account.

While the potential for profits might seem attractive, you’ll need to master specific risk control techniques before putting your hard-earned money on the line.

Understanding Basic Trading Risks

Mastering day trading begins with a clear understanding of its inherent risks. You’ll need to assess your risk tolerance and prepare for significant market fluctuations that can impact your investments. The market can shift dramatically due to unexpected news or events, and these changes can affect both individual stocks and entire sectors. Strategic stop placement is important for managing market volatility and avoiding unnecessary losses.

When you’re trading, you’ll face various issues that can impact your success. High-frequency trading involves increased transaction costs, and using margin can multiply both your gains and losses. You’ll also need to watch out for overnight risks, as positions left open can be affected by after-hours developments.

Your biggest challenges might come from within. Emotional decision-making can lead to poor choices, and overtrading can eat into your profits through excess fees. It’s important to develop proper risk management strategies, including setting stop-loss points and understanding market dynamics.

Remember that most day traders experience substantial losses, and the stress of rapid trading can affect your judgment. You’ll need to stay focused on managing these risks while dealing with regulatory requirements and market inefficiencies that can impact your trading strategy.

The Power of Quitting strategy suggests ending your trading day after a winning trade to maintain discipline and avoid emotional pitfalls. This is something we insist on here at Netpicks.

Essential Risk Management Tools

Every successful day trader relies on a strong set of risk management tools to protect their capital and optimize their trading strategy. You’ll find that modern platform tools offer extensive features to help you manage risk effectively, from built-in stop-loss orders to position sizing calculators that can keep your trades within safe limits.

| Category | Tools and Strategies |

|---|---|

| Software Solutions | – Position sizing calculators – Stop-loss order features – Credit spread strategies |

| Trading Platforms | – Thinkorswim – Interactive Brokers |

| Educational Resources | – Risk management courses – Trading guides – Community forums |

| Broker-Provided Features | – Margin limits – Pattern day trader protections – Real-time data – Direct access routing |

| Risk Management Guidelines | – 2% maximum risk per trade |

Software solutions have made risk management more accessible than ever. Start with basic position sizing calculators to determine how much capital to risk on each trade. During holiday periods, consider using credit spread strategies to benefit from time decay and lower trading costs. These tools work alongside stop-loss order features that automatically close your positions when they reach predetermined loss levels.

Many trading platforms like Thinkorswim and Interactive Brokers include these essential features.

Don’t forget about educational resources – they’re important too (like Netpicks Youtube Channel). You can access risk management courses, trading guides, and community forums to learn from experienced traders.

Your broker will also provide important risk management features, including margin limits and pattern day trader protections. Make sure you’re using real-time data and direct access routing to execute trades quickly and manage your risk more effectively.

A 2% maximum risk per trade is recommended to help protect your account from significant drawdowns during losing streaks.

Position Sizing Strategies

With your risk management tools in place, position sizing becomes your next powerful defense against significant losses.

You’ll need to decide how much of your capital to risk on each trade while staying within your risk tolerance. One straightforward approach is using a fixed percentage of your trading capital, typically 1-2% per trade. Using the Kelly method can help optimize your position sizing for maximum capital growth.

You can also adjust your position size based on market conditions. When volatility is high, you’ll want to trade smaller positions to protect your account.

During strong trends, position scaling can help you maximize profits by gradually increasing your position size as the trend confirms itself. Remember to scale back when market conditions become uncertain.

Stop losses play a important role in position sizing. Before entering any trade, calculate how many shares or contracts you can trade based on where you’ll place your stop loss.

This helps you maintain consistent risk across all trades. For example, if you’re willing to risk $100 per trade and your stop loss is $0.50 away from your entry, you’d trade 200 shares to maintain that risk level.

When trading options, consider using vertical spreads to define your maximum risk while still maintaining exposure to market movements.

Trading Psychology and Discipline

Successful day trading demands more than just technical skills – it requires mastery of your own psychology and discipline. Your emotions can impact your trading decisions, so you’ll need to develop emotional resilience to handle both wins and losses effectively. Understanding and managing cognitive biases is important for making objective trading decisions.

- Fear and greed are your biggest emotional obstacles – learn to recognize and control them.

- Create and stick to a detailed trading plan to avoid impulsive decisions.

- Practice self-awareness to identify when emotions are affecting your judgment.

To maintain discipline, you’ll need to set clear goals and establish strict stop-loss points before entering any trade.

Market volatility and rapid price movements can trigger strong emotional responses that lead to poor decisions.

| Cognitive Bias | Description | Potential Consequences |

|---|---|---|

| Overconfidence Bias | Traders overestimate their knowledge or skills | – Excessive risk-taking – Overtrading – Impulsive decisions – Substantial losses |

| Confirmation Bias | Tendency to seek information that confirms existing beliefs while ignoring contradictory evidence | – Overlooking important market signals – Ignoring data that doesn’t align with preconceptions |

| Loss Aversion | Feeling the pain of losses more intensely than the pleasure of gains | – Holding onto losing positions for too long – Exiting profitable trades too early |

| Anchoring Bias | Fixating on specific prices or values | – Difficulty adapting to changing market conditions – Basing decisions on outdated information or irrelevant price points |

| Hindsight Bias | Belief that past events were more predictable than they actually were | – Overconfidence in future predictions – Distorted perception of ability to forecast market movements |

Don’t let the pressure to profit drive you into making rash decisions. Instead, focus on following your predetermined rules consistently.

Remember, successful traders aren’t those who never experience fear or uncertainty – they’re the ones who’ve learned to manage these emotions effectively.

Consider working with a mentor or joining a trading community for accountability and support.

Regular practice through simulation and trade replay will help strengthen your emotional control and decision-making abilities over time.

Keeping a trading journal can help you identify emotional triggers and patterns that may be affecting your trading performance.

Building Your Safety Net

Building a strong safety net is important for surviving the volatile world of day trading. Your first step should be conducting a thorough risk assessment to understand how much you can afford to lose without jeopardizing your financial stability.

This means taking an honest look at your finances and determining your comfort level with potential losses.

Once you’ve established your risk tolerance, you’ll need to set clear loss limits for your trades. A common approach is following the One-Percent Rule, where you never risk more than 1% of your trading account on a single trade. For example, if you have a $10,000 account, you wouldn’t risk more than $100 per trade.

To protect yourself further, use stop-loss orders to automatically close trades when they reach your predetermined loss limit. You’ll also want to diversify your trades across different assets and avoid overtrading during slow market periods.

Keep a trading journal to track your decisions and results, and regularly review your strategy to make adjustments when needed. Remember, successful day trading isn’t about making big wins – it’s about consistent risk management and capital preservation.

Your Questions Answered

How Do I Handle Technical Glitches During Active Trades?

To handle technical issues during trade execution, you’ll need multiple broker accounts as backup.

Keep your trading platform updated and maintain stable internet connectivity.

If glitches occur, quickly switch to your backup broker or use their mobile app.

You can also call your broker’s dealing desk for immediate assistance.

Always monitor your positions closely and document any technical problems for future reference.

What Time of Day Typically Carries the Highest Risk for Day Trading?

You’ll face the highest trading risks during two key periods: the first hour after market open (9:30-10:30 AM ET) and the final hour before close (3:00-4:00 PM ET).

Morning volatility is intense as markets react to overnight news and pre-market events.

While afternoon trends are also volatile, especially the last 10 minutes when about one-third of S&P 500 trades occur.

It’s best to be extra cautious during these times.

Should I Trade Different Strategies During Economic News Releases?

You’ll need different news strategies during economic releases as markets become more volatile.

Your regular trading approach mightn’t work well during these times. Focus on trade preparation by widening your stops, reducing position sizes, and waiting for clear patterns to emerge.

Consider using specific news-based strategies like range breakouts or reversals, but only after the initial market shock has settled.

How Do Successful Day Traders Manage Their Work-Life Balance?

You’ll need strong time management skills to succeed as a day trader.

Set clear boundaries between trading hours and personal time, and stick to a consistent daily routine.

Build emotional resilience by taking regular breaks, exercising, and pursuing hobbies outside trading.

Don’t forget to schedule time for family, friends, and self-care.

Which Markets Offer the Best Day Trading Opportunities for Beginners?

For beginners, the stock market offers the most accessible entry point due to its straightforward nature and abundant educational resources.

You’ll find it easier to understand company fundamentals and market patterns compared to forex trading or crypto markets.

Start with large-cap, well-known stocks that have steady volume and moderate volatility.

They’re less complex than options or futures, and you won’t face the 24-hour stress of forex markets.