- November 2, 2023

- Posted by: Shane Daly

- Categories: Trading Article, Trading Indicators

The Chandelier Exit stands out as an objective, volatility-based trailing stop indicator that helps guide traders to set their stop losses, utilizing the Average True Range (ATR) in its calculation. The name “Chandelier” describes how the indicator hangs from the price highs or lows, much like a chandelier from a ceiling, ensuring your trades stay live when the price is in line with the prevailing trend.

This indicator steps in to exit a trade when the price moves against the position by a predetermined ATR multiple. It’s the balance between precision and flexibility; during times of low volatility, the Chandelier Exit tightens, bringing stops closer to the price. In high volatility scenarios, it loosens, allowing the stop to trail at a safer distance as the price range expands and contracts.

This indicator steps in to exit a trade when the price moves against the position by a predetermined ATR multiple. It’s the balance between precision and flexibility; during times of low volatility, the Chandelier Exit tightens, bringing stops closer to the price. In high volatility scenarios, it loosens, allowing the stop to trail at a safer distance as the price range expands and contracts.

What truly sets the Chandelier Exit apart is its dynamic nature—it adapts to price movements. The typical ATR multiple of 3 is not arbitrary; it’s a strategic choice designed to keep you in the trend longer, avoiding the pitfalls of reacting to every minor market fluctuation.

Leveraging the Chandelier Exit for Effective Trailing Stops

As a trader, once you’ve taken a position in the market, the next critical step is to implement a stop-loss strategy. While some may opt for a fixed profit target, those who follow trends – trend trading – understand the value of a trailing stop loss to maximize their trade’s potential.

The Chandelier Exit excels as a trailing stop mechanism, helping traders ride the wave of strong trends without exiting too early. It’s particularly good at adjusting to market volatility; as the pace of the market quiets down, the Chandelier Exit draws closer to the current price, ensuring that your profits are protected.

It’s important to remember, as a rule of thumb in stop loss strategies, we never move our stop loss away from the price, to avoid unnecessary risks. It’s crucial to note that while the Chandelier Exit is a reliable indicator for signaling when to get out of a trade as trends shift, it is not designed to be used for trade entries. Its sole purpose is to serve as a robust trailing stop, not as a direct signal for buying or selling.

Mechanics of Chandelier Exit Calculation and Settings

The Chandelier Exit indicator is a dual-line tool that can be used for both short and long positions, providing clear signals for when to exit a trade. It’s essential to understand that while the Chandelier Exit prompts you to close your position when triggered, it’s not a signal to immediately enter a trade in the opposite direction.

Let’s look into the adjustable settings that help tailor the Chandelier Exit to your trading style:

- Lookback Period: This determines how far back in the price history the indicator will go to find the highest high or the lowest low. It sets the stage for the calculation.

- ATR Multiplier: Typically set at 3, this figure multiplies the Average True Range (ATR), establishing the distance from the highs or lows at which your stop will be set.

Charles Le Beau, a pioneer in systematic trading, suggests a default setting of a 22-bar period with a multiplier of 3 for the Chandelier Exit.

The formula for the indicator is straightforward, though it’s usually computed automatically by your charting software:

- For a Short Position: Chandelier Exit = (Lowest Low over n bars) + (ATR(n) * Multiplier)

- For a Long Position: Chandelier Exit = (Highest High over n bars) – (ATR(n) * Multiplier)

Adjusting the ‘n’ value can be a delicate balance. Set it too close, and you risk being stopped out by normal market noise. Set it too far, and you may give up excessive profits if the market turns against you.

The goal is to fine-tune these settings to capture maximum gains while ensuring you exit trades when the market conditions have evidently shifted. It’s about striking that balance between securing profits and mitigating risk.

Using Chandelier In Uptrends

As the price of the instrument makes higher highs and higher lows, you are in an uptrend and looking for long trading positions. That is the simple price action definition of an up trend in the market. Being able to stay in the trade while the uptrend is intact, is a good use of the indicator.

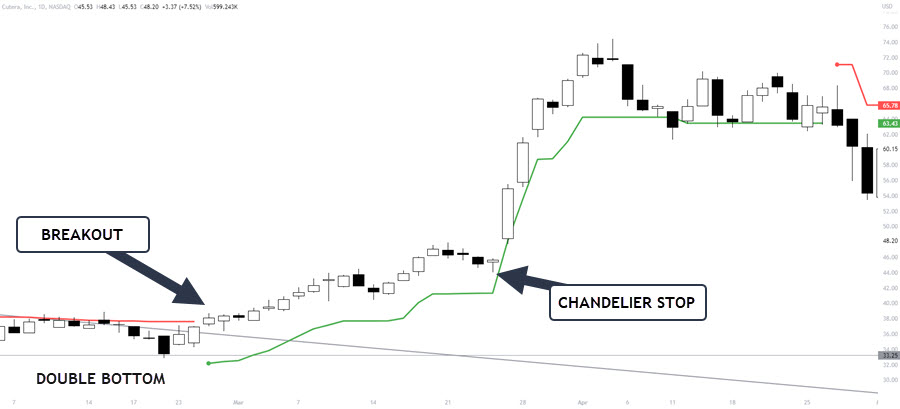

In this daily chart example, we have a breakout trade entry from a double bottom and a trend line break.

As the stock continues to trend higher, the indicator tracks underprice. On the right side of the chart, you can see the final stop location before the selloff happened.

As a trader, you may have a buffer zone below the Chandelier to avoid getting taken out of your position by simple fluctuations in price. Part of your trading plan would include your decision to exit on a touch of the line or a specific price under the line. While some traders may exit at close, this runs the risk of a large move against you before you exit.

The easiest way to use the indicator is to trail the stop after the period closes and continue to lock in gains before the stop price is hit. In this case, the stock ran 66% before exiting.

Chandelier Exit In A Downtrend

Here we have a price action downtrend and also an upsloping trend line break. Assume you enter short on the break of the trend line and your initial stop is at the red line above the entry.

As long as the price continues to make lower lows, the stop will continue to be adjusted helping you lock in gains. Notice on the right, as the price forms a trading range, the red chandelier stop line has not moved. Your stop would be at the red line looking to lock in a 6% gain on this short trade once the price crosses the line.

The Moving Average Trailing Stop

The moving average trailing stop is a popular method and let’s compare it to the Chandelier. This stop-loss method utilizes a moving average of the price to trail the stop level. Traders will typically take a simple moving average of the closing prices over a set period like 20 or 50 bars. As the moving average trails the price action, it acts as the adaptive trailing stop. When the price reverses and breaks back through the moving average by a set amount, the stop is triggered.

Advantages:

Advantages:

- Smooths out market noise since it trails a moving average, not just the high/low price directly. This helps avoid premature stop-outs.

- Easy to implement in most charting platforms. Simple moving averages are a standard indicator.

- Provides flexibility in tailoring the length of the moving average and distance for the stop trigger.

Disadvantages:

- Can lag trends and give back more profits compared to a true price-based trailing stop.

- Requires careful optimization of the moving average length and stop trigger distance.

- May not adapt as well to expanding volatility like a Chandelier Exit can.

This method serves as a straightforward, smooth approach to trailing stops. However, it tends to lag price more than volatile-based methods. The Chandelier Exit has advantages in strongly trending markets. Comparing and contrasting the two approaches to decide which one fits your trading strategy the best.

Conclusion: Chandelier Exit for Trend Trading

Trailing stops are an invaluable tool for holding onto the bulk of the gains in a trending market. The Chandelier Exit, with its use of price extremes and the Average True Range (ATR), offers a robust framework to capture the bulk of significant market moves.

As the trend continues, the Chandelier Exit comes in handy, ensuring you remain in the trade and not get popped out by market noise.

Adjusting the settings of the Chandelier Exit is a personal choice, but it’s crucial to strike a balance that you’re comfortable with—one that mitigates the risk of lost profits and avoids the frustration of being stopped out by market spikes. Such frustrations can often tempt traders to deviate from their trading plans, seeking to recoup losses, but discipline is the cornerstone of successful trading.

Employing the Chandelier Exit as your trailing stop allows you to navigate strong trending markets, staying in the trade longer than if you had set a static exit target. As market volatility begins to die off, the Chandelier Exit tightens, safeguarding your profits from getting eaten up by adverse price action.

Remember, the Chandelier Exit is designed to signal the optimal exit point from a trade, not to serve as a direct trading signal. In sideways markets, the indicator will oscillate between long and short signals. It’s imperative to have a solid trading plan that can identify and keep you out of range-bound conditions, utilizing the Chandelier Exit for its intended purpose.

Take Action: Now that you understand the strategic advantage of the Chandelier Exit, it’s time to put this knowledge into practice. I encourage you to backtest the Chandelier Exit indicator with your trades. Analyze its performance, tweak the settings, and observe how it can transform your trading strategy. With disciplined application and thorough backtesting, the Chandelier Exit could become a cornerstone of your trading approach.

Unlock Your Trading Potential!

Trading Indicator Blueprint

Discover the secrets behind popular trading indicators like Moving Averages, Keltner Channels, Stochastics, MACD, and more.

While others might charge $197 for such insights, we’re offering it to you for FREE!

50+ Pages

4 Professional Videos

Actionable Trading Systems

1 Comment

Comments are closed.

Thank you for your plainly written articles, and the links embedded to the article for quick and easy reference. These insights are extremely helpful compared to all the dry, technical articles that expect the reader to already be a master of all things trading related.

I appreciate you, and when/if I become more profitable I will buy any book you are selling to show my gratitude.

I do go green even in this messed up market and thanks to you I hope to scale that up in the near future.

Thank you.