- August 23, 2022

- Posted by: Shane Daly

- Category: Trading Article

The three exponential moving averages (EMA) cross signal is a method traders can use to trade stocks. While moving averages are lagging technical indicators, they are useful tools to help you frame the market.

Moving averages are specifically good at smoothing out the constant gyrations of price. In addition, they provide an average value that can be used as a reference point when making decisions about buying and selling. Instead of buying and selling at any price level on the price charts, using the techniques described in this guide, can help traders focus their attention on one particular zone of price.

After that, traders can use various basic price patterns to determine when they want to trade.

After that, traders can use various basic price patterns to determine when they want to trade.

Why Use 3 EMA For A Strategy?

Moving average lines aren’t particularly special regardless of what some will tell you, but they can form the bases of a stock trading strategy that works. Moving average trading systems can be used to create many different types of trading strategies, but they’re not necessarily the best for every situation. As long as you understand what each type of strategy does and how it works, you should have no problem creating your moving average system that fits your needs perfectly.

Three moving averages gives us 3 important pieces of information:

It shows us the longer-term direction of the market and whether we’re currently in an uptrend or downtrend, and if it is a strong trend. We will be using the 50 EMA for trend direction.

We can also see the direction of short-term momentum (10 EMA) and have an area we can look to trade from (30 EMA).

We can use short-term trends to determine whether we’re going long or short a stock against the main trend. This is known as counter trend trading and if you know price exhaustion types of patterns, this is a viable strategy. For this, we will use a crossover of the 10 EMA and the 30 EMA.

These averages can give us an objective means to trade stocks without relying too much on personal opinions. They allows us to have set rules in our trading plan which gives us consistency in our trading….only when we follow it.

Trading Strategy With Three Moving Averages

We could just use the 3 EMA’s to create a simple moving average crossover strategy. If you decide to take a position based solely on a cross of any MA in the direction of the current trend, expect a large number of false signals as the averages whipsaw around price.

We can do better than that.

We can look at how the moving averages are lined up to give us an idea of if this stock is worth trading.

When the indicators are jumbled together, consider the stock to be in transition and wait for better conditions.

When the indicators are jumbled together, consider the stock to be in transition and wait for better conditions.

If the faster-moving average starts pulling away from the rest, in this case, the 10 EMA, consider momentum is showing up in your stock

If the price is heading towards the 30 EMA, we want to be on alert for a potential price reversal back in the direction of the 50 EMA.

We can’t ignore price structure and you should be aware of any support or resistance level close to where you are trading.

Strategy Rules For Buying

If we want to buy a certain stock, here are the steps you will want to consider taking.

Look for stocks in an uptrend where the 50 EMA is below all the averages and rising

Wait for the 10 EMA to cross above the 30 EMA

Look for a retest of the 30 EMA price zone

Look for a reversal in price

Enter the trade and set your protective stop loss.

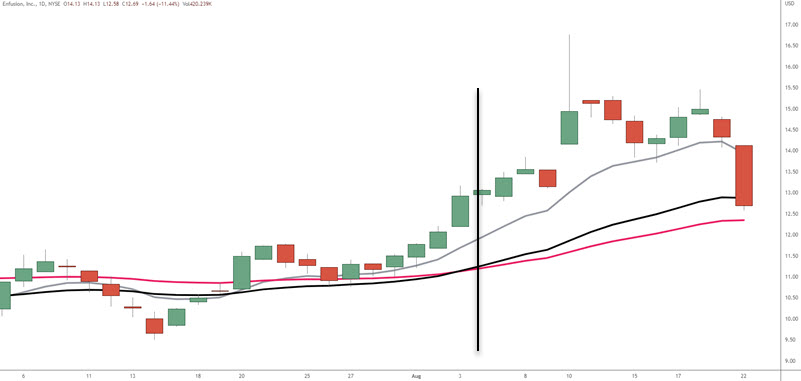

In this example, you can see all the variables have lined up for a trading setup.

Price has pulled back into our setup zone and even if price breaks the 50 EMA, the setup is still valid. A trader should know what trending price structure looks like and as long as we don’t make lower highs and lower lows, the uptrend is still playable.

Trade Entries

We can have a setup as price pulls into our zone but we also need a trigger to get us active. There are many ways to do this including looking at lower lower time frames. In our example, we have a small consolidation and a breakout of that can be a simple entry.

If we used a lower time frame such as the one hour, we can use a break of a swing high and a cross of the 10/30 EMA combo for our trigger.

You could also use range breakouts, trend line breaks, or simple reversal candlesticks for a trigger. What’s important is that you have one that you consistently use.

This daily chart meets the setup criteria but we are missing any sort of trigger into a long trade.

One thing you should be mindful of is momentum during the decline of price. While this could simply be the last gasp of shorts/sellers, it could also be the makings of a new downtrend. If you are watching this ticker, ENFN, you will want to see price begin to stall around this zone. Next up, look for a trade trigger to get you long.

Setting Your Protective Stop Loss

There are many different ways to set your stops on these kinds of trades including:

Using an ATR stop loss, placing your stop under the swing low, and using the closest support zone for your stop are all viable approaches.

In our first trade, simply putting your stop loss a little under the low of the consolidation is a viable approach for this price pattern trade entry. We don’t expect, once a breakout occurs to the upside, to see price head back under the lows of the range. If it does, it’s an obvious failure and we’d want to be out of the trade.

How To Take Your Profits

When trading with moving averages, there are a few ways to take profits on winning trades. One way is to set a profit target at a certain level above the entry price. You could take the amount you are risking and look to take 2-3 times that in profits.

Another way is to let the trade run until the price moves below the moving average. This signals that the trend has reversed and it is time to exit the trade. You could use the 10 EMA for a partial scale out and the 30 EMA break for a full position exit on the stock.

Another way is to let the trade run until the price moves below the moving average. This signals that the trend has reversed and it is time to exit the trade. You could use the 10 EMA for a partial scale out and the 30 EMA break for a full position exit on the stock.

You could use a break and close under the 10 EMA for a more scalping exit. A close under the 30 EMA is more of a swing exit and a close under the 50 ends your position trade. You can even use the moving averages as points to scale out of your position.

One warning though if using closing prices for exits. It can, has, and will happen where a very large momentum candle heads to the downside breaking all of the averages in one day. If waiting for the close and depending on the context of the trade, your winner can easily become a loser.

There is no one way of doing things. The bottom line is what suits you as a trade.

Conclusion

This is a simple strategy that can be used to trade stocks in an uptrend. By waiting for the 10 EMA to cross above the 30 EMA, we can be confident that momentum is to the upside.

Looking to trade a pullback (bull flag) is taking advantage of a pause in the price action. Setting stops under the low of the pullback and then taking profits at 2X your risk, is a simple approach for traders to start with.

To learn how to short stocks using Options for even more opportunity, makes sure to download your free Options Trading Guide here.