- November 23, 2022

- Posted by: Shane Daly

- Category: Dividends

CRITICAL NEWS: Massive Social Security COLA Increase for 2023!

If you’re among the lucky who have made it to the age where you can collect social security… congratulations!

Many never make it to 62 years or older. So you’re ahead in the game of life.

Really, it’s a blessing even though I know many folks feel the heavy burden that aging brings.

We all know the list is long…

Do I have enough money to live the life I want in retirement? Or, can I even retire?

How will I pay for all these doctor visits and medication?

If my spouse dies (or has died) who will take care of me as my health fails?

Will I have my mental faculties?

Will I have anything left to help my kids or grandkids with their future?

Yeah, it’s a glass half-full, half-empty scenario. But again, you’re still alive and kicking!

Half Full Outlook

I always see the glass half full because like plenty of folks reading this, I lost my mother when she was 53 and I was just in my late 20’s… way too early. But my Dad has made it to the ripe old age of 79 now.

So I take my cue from my father who has been able to find the joy in retirement I only hope for. He’s retired from the railroad with a special tiered social security pension, has other income generating investments including a rental property, stocks, bonds… you get the picture. But that’s just the finance side.

He’s very active and plays golf a few times a week (when the weather cooperates), works around the house and his rental property and vacations all the time. Aruba is practically his second home!

Sure, he’s had a few serious health conditions hit in the last decade… and yes- like everyone else, he’s got to contend with the rising cost of healthcare and medication.

But he’s made lots of good decisions and while he had fun when he was working – a lot went into this moment for him, future planning. Stashing it away to enjoy it in his golden years, and still cover the hard costs of real life.

Again, I can’t stress enough that I’m lucky as I have an impeccable role model for how to retire with joy and be content. I talk to him regularly about retirement issues as I am focused on helping others find joy and happiness in their golden years. And we all know that takes some amount of money.

Cost Of Living Adjustment (COLA)

So when we were talking a few weeks ago the topic of the upcoming social security COLA (cost of living adjustment) came up. He was excited to see such a massive pop in his monthly benefits. If you didn’t hear yet, Social Security beneficiaries will now see an 8.7% increase in their benefits!

This will kick in January 2023…

And that’s a sticky 8.7%, meaning it’s not going anywhere. What timing! This is a huge help for my Dad and others who are on a fixed income and getting slaughtered by massive inflation in food, energy, and basically everything!

So how large is the COLA for 2023?

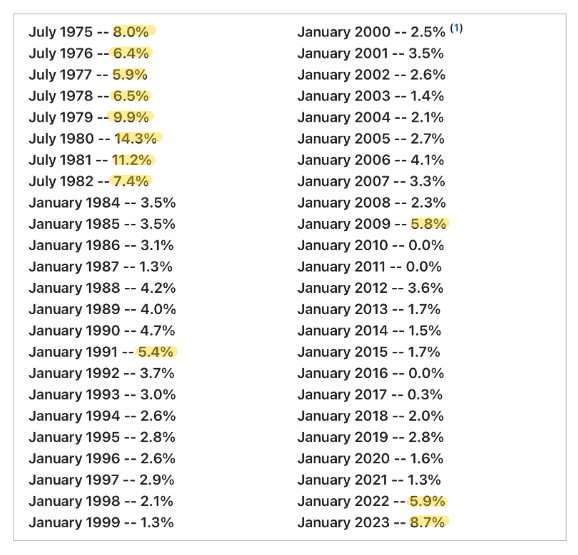

Let’s compare it to all prior years to see how it stacks up. Take a look at the below table from the Social Security Administration. I pulled this right from ssa.gov website, so we know it’s accurate:

I took the liberty of highlighting all of the years where the SSA COLA was 5.0% or greater. You can see that since they began in 1975 (due to epic inflation) we’ve only seen a 5.0% or greater COLA 12 times. That’s just 12 times in the past 48 years.

So this year is in the top 5 all-time.

So this year is in the top 5 all-time.

But I want to look a little deeper, so let’s have a little fun with math, shall we?

If we take the average COLA for this entire table from 1975 to 2023, that’s an average of 3.7%.

But most of that was in the first 8 years until 1982. From 1984 until 2021, that average increase ends up being just 2.6%. Still not bad as inflation has been tame many of those years…

So how does the SSA COLA stack up against inflation over the years?

COLA VS INFLATION

That’s easy. The COLA is calculated using the CPI-W. In general, The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. CPI-W simply is the CPI hitting office and clerical workers. So these numbers should align with real inflation. But let’s do the math, shall we?

Here’s how inflation has impacted the US Dollar in the past 48 years:

To have the same $100 of spending power in 1975, you need to have $551.69 in 2022!

That’s a cumulative price change of 451.69%! And an average inflation rate of 3.7%. I’d say our government has gotten something right once and for all!

If the goal of the COLA is in place to help seniors offset the bite of inflation to their SSA benefits, then the COLA is right in line with the average inflation rate over the past 48 years.

So if you’ve yet to retire just yet don’t be worried that you “missed out” on this big jump in pay…

COLA Upgrade = Permanent

These COLA adjustments are permanent in nature. Meaning, there’s no claw-back in the rate of pay (like if you were to buy an I-Series bond, the rate is CPI adjusted and is pretty high right now, but will go right back down when the inflation falls).

That means you’ll also see your social security benefits will be higher than last year’s when you’re ready to collect. That is if we still have social security in place when you (or I) are ready to retire and collect… ugh.

For your own benefit, take a look at your SSA statement this year and compare it to the benefit amount next year. You should see the estimated benefit rise (assuming all your other inputs are stable).

If like me and you’re not planning on seeing a dime from social security… What are you doing to ensure you have enough income in retirement to offset the bite of inflation?

Follow My Roadmap

I am planning on using dividend paying stocks… the swiss army knife in the financial toolbox.

I write about different dividend stocks every month, which I believe are the strongest tool in the toolbox for steady income with the upside of growing your nest egg…

I also give you my thoughts on living a joyful retirement (just like my Dad has). Because there’s more to retirement than just investing your money!

For pennies a day you can access my dividend stock portfolio, AND get access to my premium articles and research on retirement!

Click here to sign up today: I’m going to be sharing my next dividend stock idea in just a few days with subscribers – don’t miss out.