- January 13, 2026

- Posted by: Mark S

- Categories: Passive Income, Trading Article

Most passive income strategies fail because they turn into full-time jobs—constantly worrying about payouts, reinvesting, or market moves. This article shares a simple, rules-based system that takes just 10 minutes a month to manage while building reliable cash flow and protecting your capital.

True passive income means less stress, not more decisions.

The problem with most plans is that once your passive income streams are running, they often create a flood of questions and decisions that can quickly become overwhelming:

- “Is this payout sustainable… or am I bleeding principal?”

- “Do I reinvest, take cash, or hold?”

- “Should I change something?”

- “What if the market goes down? When should I buy? Sell? Panic?”

- “Am I missing a better option?”

That’s portfolio babysitting—and it turns “passive” into a part-time job if not worse.

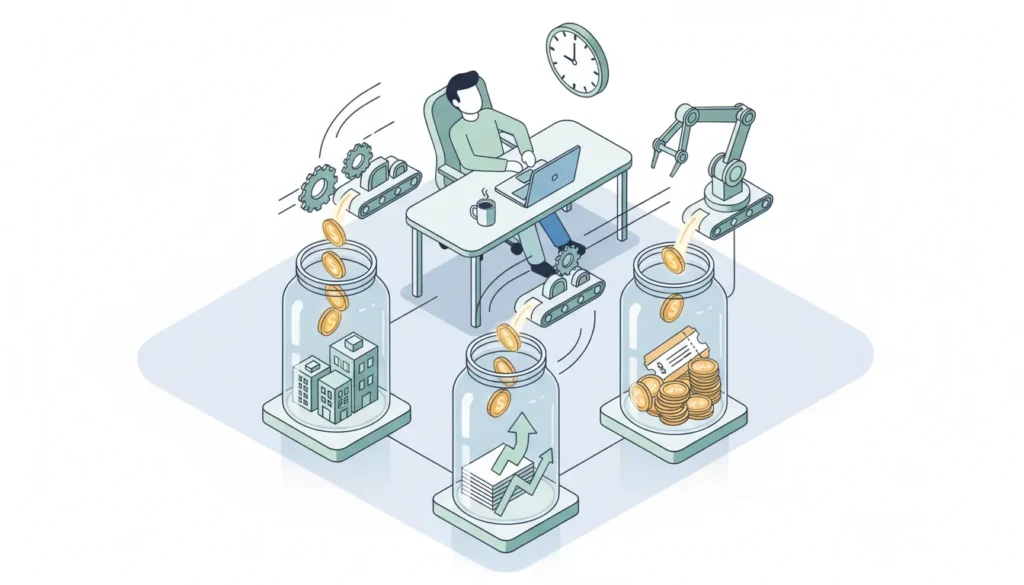

Here’s the fix: a simple operating system that builds three lanes (growth, cash flow, protection), automates the mechanics, and reduces your monthly maintenance to a short checklist.

Want the full walkthrough + examples?

Register for the free live workshop: https://www.netpicks.com/passivestreams

The idea in five seconds…

Build three passive-income lanes—Growth, Income, and Protection—then run them with a rules-based routine so your money works while you live your life.

Three lanes. One simple routine. Zero babysitting.

The 3 lanes (and one example for each)

Think of your portfolio like a small business. Each lane has a job:

| Portfolio Style | Growth Lane | Income Lane | Protection Lane |

|---|---|---|---|

| Conservative | 30% | 50% | 20% |

| Balanced | 40% | 40% | 20% |

| Income-Tilted | 25% | 60% | 15% |

1) Growth lane (build net worth)

Purpose: long-term appreciation

Example: a simple basket of growth-focused ETFs or selected large-cap growth names

Rule: you don’t touch this lane daily—review on schedule only. Best with some simple long-term market timing tools.

2) Income lane (create paychecks)

Purpose: recurring cash flow

Example: covered-call / option-income ETFs (single-stock or baskets), dividend ETFs, income funds

Rule: high payouts don’t eliminate risk—this lane needs rules for payouts and position sizing.

3) Protection lane (reduce drawdowns)

Purpose: stability + dry powder when markets get ugly

Example: high-yield cash, buffered/hedged ETFs

Rule: protection isn’t about “never down”—it’s about less down and less stress.

You don’t need all three lanes perfect on day one.

You just need a starting blueprint and rules to keep you from improvising.

The 60-minute setup (then 10 minutes per month)

Do this once, then stop tinkering.

Step 1: Set your lane targets (your blueprint)

Pick a starting mix:

- Conservative: 30% Growth / 50% Income / 20% Protection

- Balanced: 40% Growth / 40% Income / 20% Protection

- Income-tilted: 25% Growth / 60% Income / 15% Protection

Your mix depends on your goals and how you handle drawdowns.

Step 2: Decide position sizes before you buy anything

This is where most people go wrong.

Start with smaller “starter” positions for new strategies, then scale once the process is working.

Step 3: Turn on automation

Automation is what makes passive income feel passive:

- reinvestment (compounding)

- recurring contributions

- scheduled deposits

If automation is on, your system becomes boring—in the best way.

Step 4: Write payout rules (this stops the babysitting)

When payouts hit, you’ll do one of three things:

- Pay yourself (income now)

- Compound (income later)

- Split it (50/50—motivation now + growth later)

No monthly improvising.

Step 5: Set your “do nothing” rules

- Only rebalance if a lane drifts more than ±5% from target

- Only change a position if your proven market timing shows Bearish (we’ll share how we do this in the live workshop)

- Otherwise, you do nothing and let the system run. Remember, this is not active trading.

Covered-call / option-income ETFs: the income engine (and the watch-outs)

Covered-call and option-income ETFs can be powerful for the Income lane because they aim to convert market volatility into steady, recurring cash flow through recurring distributions—without requiring you to trade options yourself.

Why people love them:

- frequent cash flow

- simple to buy/sell at any broker

- you don’t place options trades yourself

What to watch:

High payouts do not remove underlying price risk. If the underlying is in a prolonged downtrend, you can still experience principal decline even while distributions continue.

That’s why this approach works best when paired with:

- position sizing rules, and

- a simple timing/check routine so you’re not holding through prolonged weakness.

A real-world example: individual stock covered call ETF for Tesla: TSLY

| ETF Name | Manager | Assets Under Management | Cash Flow Yield Range | Strategy Summary |

|---|---|---|---|---|

| TSLY | YieldMax | $1+ billion | 35% – 75% | Covered calls on Tesla stock, repeated on other top names |

Traded by YieldMax with over $1 billion in assets under management we’ve seen cash flow yields from 35% – 75% on TSLY. All by simply buying one stock, one time.

However, you have to be very careful of timing these buys right. While the cashflow remains constant – the downside risk of the underlying equity is always a factor. We use simple market timing to put the odds in our favor of continued upside. Don’t miss this part.

(We cover exactly how to do this without babysitting in the live workshop.)

Hands-off real estate: cash flow without landlord life

You don’t need to be a landlord to get real estate cash flow.

Hands-off pathways include:

- fractional real estate (small slices of rentals)

- turnkey rentals (you own it; managers run it)

- commercial income vehicles (professionally managed)

What to watch:

Real estate can deliver steady cash flow while valuations move around. Separate “cash yield” from “asset price,” and use rules for when you would add/trim exposure—don’t react emotionally.

For example, you could go to Lofty.AI and purchase fractional ownership in dozens of individual rental homes, commercial strip centers and more. With cashflow in the 10% – 25% range in many cases. All 100% passively.

Just like with covered call ETFs however you need to be very mindful of which assets you buy. They can go down in value despite the cashflow. We’ll share with you how we evaluate thse properties in seconds with AI and a smart framework during the live workshop (register below)

The stability layer: the stress reducer

This lane is what keeps you from panicking when markets get weird.

Examples include:

- high-yield cash for dry powder

- buffered ETFs (defined-outcome style protection windows)

- hedged income approaches

The point isn’t perfection.

The point is a smoother ride so you can stay consistent.

You could look into Buffered ETFs from PGIM. Imagine being able to eliminate the first 10%, 15%, 20% or even 100% of the downside in exchange for just limiting only some of your upside.

Tracking & automation: make it easier in 2026

Once your lanes are set, modern tools make this dramatically easier.

Two examples people use:

- Kubera — tracks assets across brokers, real estate, crypto, and private investments in one dashboard

- Snowball Analytics — focuses on income-producing assets and helps visualize distributions and cash-flow history

Automation ideas:

- set distributions to reinvest or deposit based on your payout rules

- calendar reminders for a monthly 10-minute review

- rebalance only when a trigger is hit

The monthly 10-minute checklist

- ✓ Confirm cash flow hit (dividends/distributions/interest)

- ✓ Confirm automation ran (reinvest/recurring add/deposit)

- ✓ Scan for any liquidity events (capital calls, lockups, etc.)

- ✓ Review your market timing

- ✓ Change only if the timing says you should – otherwise do nothing :)

That’s the whole point: scheduled simplicity.

Common pitfalls (and how to avoid avoiding success)

| Pitfall | Explanation | How to Avoid |

|---|---|---|

| Over-monitoring | Checking your portfolio too frequently leads to emotional decisions | Stick to a monthly 10-minute review routine |

| Confusing Yield with Total Return | Focusing only on income ignores principal growth or loss | Track both cash flow and portfolio value |

| Ignoring Liquidity | Holding assets that can’t be easily sold when needed | Know which assets are liquid vs locked or with capital calls |

| Oversizing New Strategies | Putting too much capital into unproven approaches | Start small and scale only after confirming success |

Want the live walkthrough and examples?

In the free live workshop, I’ll show:

- how to set this up step-by-step

- how the payout rules work in real life

- the minutes-per-month routine that keeps it calm

- and how to activate your first stream quickly

Register here: https://www.netpicks.com/passivestreams

Quick FAQ

How much time does this take monthly?

About 5-10 minutes if your automation and rules are in place.

Can covered-call ETFs be part of the income lane?

Yes—effective for cash flow, but they still carry underlying equity risk. Use sizing + timing rules.

Can I start with only a few thousand dollars?

Yes—start small, prove the routine, then scale.

What if I don’t want to manage real estate?

Use professionally managed options like fractional or turnkey pathways.

What tools help keep everything in one place?

Kubera and Snowball Analytics are two examples that can simplify tracking across assets.

Free Live Workshop – Create Two Passive Income Streams This Week |

|

Passive Income without the Portfolio Babysitting – Wednesday, January 21st @ 12pm Eastern/9am Pacific |

| Grab Your Free Spot Here |