- September 3, 2025

- Posted by: Jay Soloff

- Category: Trading Article

The Wheel Strategy combines selling cash-secured puts and covered calls to create steady investment income. Research shows strong performance over five years, with returns exceeding 50% for puts and 75% for covered calls. Investors start by selecting quality stocks and conservative strike prices, then adjust their approach as they gain experience. The strategy’s mechanical nature and systematic approach help reduce risk while maximizing profit potential. Understanding its key components opens the door to consistent trading success.

Video Highlights

- Begin with cash-secured puts on high-quality stocks you wouldn’t mind owning to establish a strong foundation.

- Select conservative strike prices initially, then adjust strategy aggressively as experience and confidence grow.

- Implement systematic stock selection criteria focusing on stable companies with reliable options premiums.

- Maintain mechanical execution of the strategy while adapting strike prices to current market conditions.

- Diversify across multiple wheel positions to create consistent income streams and reduce single-stock risk.

Understanding the Wheel Strategy’s Performance and Implementation

The Wheel Strategy has is a powerful approach for investors seeking consistent returns in the options market. This systematic method combines two fundamental options strategies: selling cash-secured puts and covered calls.

The strategy begins with careful put selection, where investors sell puts on stocks they wouldn’t mind owning at a lower price. When the put expires worthless, the investor keeps the premium and can repeat the process. If assigned, they transition to the call strategy phase, selling covered calls against their newly acquired shares.

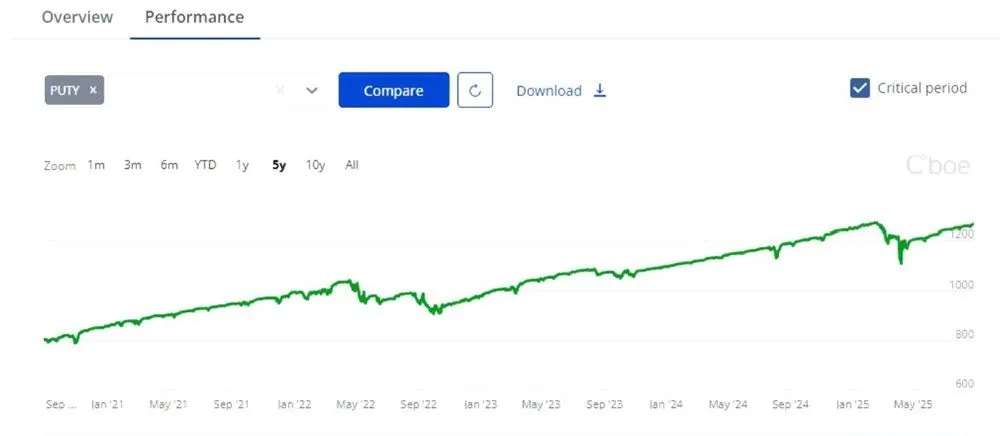

Performance data from CBOE benchmark indices demonstrates the strategy’s effectiveness over time. Analysis of cash-secured puts shows notable stability, with returns trending upward over a five-year period. Starting from an index value of approximately 800, the strategy yielded gains exceeding 50%, reaching above 1200. This performance remained strong even during periods of market uncertainty, including inflationary pressures and trade tensions.

The covered call component of the Wheel Strategy has shown even more impressive results. Over the same five-year timeframe, returns increased from 2 to approximately 3,500, representing a 75% total return. While this higher return comes with increased volatility due to stock ownership, the strategy has proven its ability to generate steady income while maintaining stability during market downturns.

Recent research continues to refine the approach, focusing on optimizing stock selection and strike price choices. The strategy’s success lies in its mechanical nature and ability to adapt to different market conditions.

By collecting premiums consistently through both put and call sales, investors can potentially generate regular income while maintaining a defensive position against market volatility.

For investors looking to implement the Wheel Strategy, starting with quality stocks and conservative strike prices is essential. This approach allows for a learning curve while minimizing risk.

As comfort and experience grow, traders can adjust their approach, potentially increasing returns through more aggressive strike selection or expanding their portfolio of wheel positions.

Your Questions Answered

How Do You Handle Dividend Payments When Running the Wheel Strategy?

Traders running the wheel strategy typically handle dividends in two ways. When assigned shares through put options, they can collect and reinvest dividends to compound returns, or use the cash for new trades.

Payout timing matters because dividend dates affect option prices. Before ex-dividend dates, call options become more expensive, while put options generally become cheaper, influencing strategy adjustments.

What Is the Minimum Account Size Needed to Start the Wheel Strategy?

A minimum account balance of $5,000 to $10,000 is typically recommended to start the wheel strategy effectively.

This allows traders to target stocks priced between $20-50 per share while maintaining proper position sizing and risk tolerance.

Some brokers require higher minimums for options trading.

Starting with a larger account provides more flexibility in stock selection and better risk management through diversification.

Should I Roll Options Positions When They Approach Expiration Date?

Rolling options positions near expiration depends on the trader’s outlook and market conditions.

If a position is profitable, it’s often better to close it and start fresh. However, if facing a loss, rolling can provide more time for the trade to work out.

The key is to evaluate whether rolling offers better opportunities than closing the position and starting a new trade elsewhere.

How Do Taxes Impact Profits When Implementing the Wheel Strategy?

The wheel strategy creates multiple taxable events through stock assignments and option premiums. Each put or call sale generates income taxed at ordinary rates.

When stocks are assigned and later sold, capital gains taxes apply based on holding period. Traders must track cost basis carefully, as frequent trading can impact profit calculations and potentially increase tax liability.

Good record-keeping is essential for accurate tax reporting.

What Screening Criteria Should I Use to Select Stocks for Wheeling?

Effective stock screening tools can identify suitable wheel strategy candidates by focusing on several key criteria.

Stocks should have moderate volatility, typically between 30-50%, and trade above $20 to ensure adequate premium collection.

Look for companies with strong fundamentals, consistent earnings, and high trading volume. Blue-chip stocks often work well due to their stability.

Avoid stocks with upcoming earnings or major announcements that could cause price swings.