- January 26, 2024

- Posted by: Shane Daly

- Categories: Stock Trading, Trading Article

Company earnings are important for assessing a stock’s value. They reflect not only past performance but also future potential. Investors should pay attention to revenue, profit, and EPS figures, which significantly influence long-term stock trends.

Future earnings also impact investor sentiment and can cause stock price volatility. Monitoring these financial indicators is essential for informed investment strategy and portfolio growth.

Future earnings also impact investor sentiment and can cause stock price volatility. Monitoring these financial indicators is essential for informed investment strategy and portfolio growth.

Quick Take: Company earnings significantly shape your stock’s value because they provide insights into past performance and future potential, influencing long-term trends. Analyzing key figures such as revenue, profit, and EPS helps in understanding a company’s financial health. Future earnings projections also impact investor sentiment, leading to stock price volatility.

Understanding Earnings Reports

Earnings reports provide a company’s financial performance metrics, offering investors critical insights into its profitability and potential stock value. You study these reports to gauge earnings quality, which indicates the reliability and sustainability of a company’s income. High-quality earnings suggest that a firm’s profits are likely to continue, this means it’s probably a stable investment.

Report timing is equally important. Public companies release earnings quarterly and annually, with many investors anticipating these disclosures. The timing can affect a stock’s price as markets react. If you’re invested in stocks, you know that an earnings report can lead to volatility depending on whether the company meets, exceeds, or falls short of analysts’ expectations.

You analyze various components within these reports, such as revenue, expenses, profits, and earnings per share. By digging into this data, you can identify trends and make educated guesses about future performance. In doing so, you look beyond the numbers to consider external factors that might influence earnings quality, such as economic conditions and industry trends.

Objective and detailed analysis of earnings reports enables you to make educated decisions about buying, holding, or selling stock. It’s a critical part of your investment strategy, ensuring you’re not caught off guard by market shifts driven by new financial data.

Revenue and Profit Analysis

Looking into a company’s financial health, you must analyze both revenue streams and profitability to grasp the underlying value and prospects of the stock. You’ll start by examining the revenue, which is the income generated from sales of goods or services before any costs or expenses are deducted. This top-line figure gives you an initial indication of the company’s market position and growth potential.

Revenue alone doesn’t tell the whole story. You also need to consider the cost structure, which includes the variable and fixed costs that the company incurs to generate its revenue. A detailed analysis will reveal the efficiency of the company’s operations and its ability to scale.

The gross margin, calculated as the difference between revenue and the cost of goods sold divided by revenue, is a metric for assessing profitability. It reflects the percentage of revenue that exceeds the costs directly associated with production. A higher gross margin implies a more profitable company, assuming overhead costs are managed effectively.

Let’s consider a fictional company called ABC Electronics, which manufactures and sells smartphones. ABC Electronics generated $1,000,000 in revenue from smartphone sales in a given year. The cost of goods sold (COGS), which includes expenses like the cost of materials, labor, and manufacturing, amounted to $600,000 for the same period.

To calculate ABC Electronics’ gross margin, you would use the formula:

Gross Margin = (Revenue – Cost of Goods Sold) / Revenue

In this case, it would be:

Gross Margin = ($1,000,000 – $600,000) / $1,000,000 Gross Margin = $400,000 / $1,000,000 Gross Margin = 0.4 or 40%

ABC Electronics has a gross margin of 40% for that year. This means that for every dollar in revenue they generated, $0.40 was left after covering the direct costs associated with producing the smartphones. A higher gross margin indicates that the company is more profitable, assuming it effectively manages its overhead costs such as salaries, rent, and marketing expenses.

You’ll also look at net income, the bottom line, which is what remains after all operating expenses, taxes, and interest payments are deducted from the gross profit. This final profit figure is essential for understanding the company’s actual earnings and its capacity to deliver value to shareholders.

Earnings Per Share (EPS)

When assessing a company’s profitability, one must consider Earnings Per Share (EPS), a metric that indicates the portion of a company’s profit allocated to each outstanding share of common stock. EPS is calculated by dividing the net income by the number of outstanding shares. It provides a snapshot of a company’s financial health and profitability on a per-share basis, making it important for your investment analysis.

Analyzing EPS in a vacuum can be misleading due to potential earnings manipulation. Companies can engage in various accounting practices to artificially inflate their EPS, presenting a distorted view of financial performance. You should be wary of such discrepancies, as they can affect the stock’s perceived value.

Dividend impact on EPS is also a significant factor to consider. A portion of profits paid out as dividends isn’t reinvested into the company, which might reduce the growth potential reflected in future EPS figures. However, a consistent dividend payout can also signal financial stability and may compensate for lower EPS growth.

Future Earnings Guidance

While EPS offers a snapshot of past performance, investors also look at future earnings to anticipate a company’s potential growth and profitability. This forward-looking information can be important for your investment decisions because it provides insight into management’s expectations for the company’s financial future.

Future earnings guidance is often mentioned during earnings calls or in financial statements. Companies may provide projections for the next quarter or fiscal year. Here are some aspects to consider:

- Analyst Expectations: Analysts’ consensus estimates serve as a benchmark for guidance. If a company’s projections significantly diverge from these estimates, it could lead to market volatility.

- Earnings Surprises: When actual earnings differ from guidance, it’s known as an earnings surprise. Positive surprises can lead to stock price appreciation, while negative surprises can cause declines.

- Revenue Projections: Along with earnings, revenue forecasts are a key component of guidance, influencing investor sentiment about a company’s growth trajectory.

- Operational Metrics: Additional metrics, such as customer acquisition rates or production targets, can provide a more comprehensive view of future performance.

You need to analyze not just the numbers but also the context in which they’re presented. Factors like market conditions, competitive landscape, and macroeconomic trends can all influence the reliability of future earnings guidance.

Market Reaction and Volatility

Investors’ reactions to earnings announcements can trigger significant stock market volatility, reflecting the collective sentiment toward a company’s financial health and prospects. The immediate aftermath of an earnings report often sees heightened trading activity as market participants adjust their positions based on the new information.

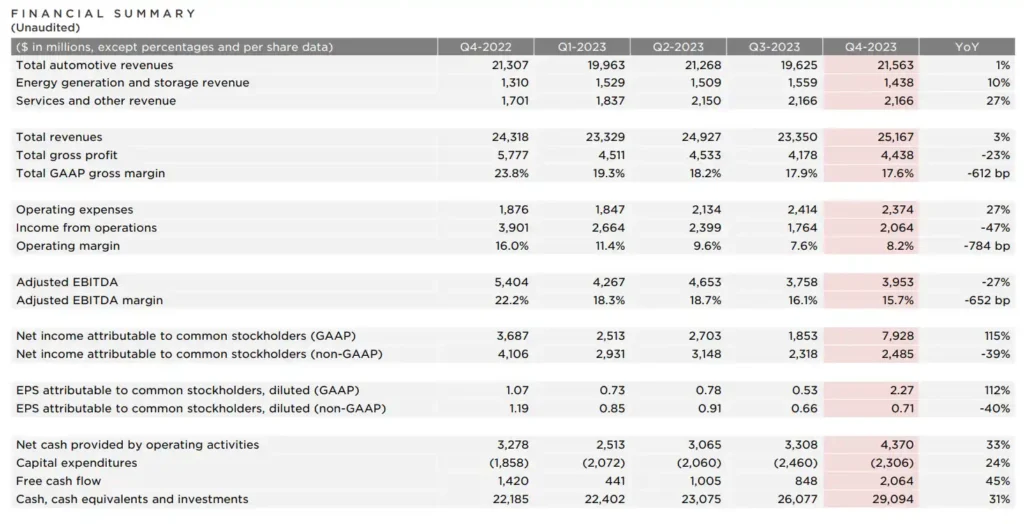

This is a stock chart of TSLA which recently missed earnings expectations. It was the worst day for Tesla stock since 2020.

If you’re observing this as an investor, understand that stock prices can swing wildly, not only on actual earnings outcomes but also on how these outcomes match, exceed, or fall short of market expectations.

If you’re observing this as an investor, understand that stock prices can swing wildly, not only on actual earnings outcomes but also on how these outcomes match, exceed, or fall short of market expectations.

Investor sentiment, a complex and sometimes unpredictable force, plays an important role in this process.

- Positive earnings surprises can lead to a surge in stock prices, as optimism floods the market, prompting more buying than selling.

- A negative earnings report can spark a sell-off, driving the stock price down.

Your trading strategies must account for this volatility. An analysis of past earnings, industry, and the broader economic context can help you forecast potential market reactions.

Volatility is often made worse by algorithmic trading, where computers execute trades based on pre-set criteria, including earnings releases. Volatility isn’t just noise; it’s a reflection of the interplay between actual company performance and investor expectations.

Conclusion

Your stock’s value is linked to company earnings. Analyzing earnings reports, including revenue and profit, provides insight into financial health.

The EPS metric offers a direct valuation of your stake. Future guidance sets market expectations, influencing the direction of the assets you hold.

Market reactions can induce volatility, affecting short-term prices. Stay informed and examine these financial indicators to gauge your stock’s potential and make decisions based on actual data instead of hope and fear.