While the term breakout in trading can seem self-explanatory, there are some that are still confused as to what a breakout is.

There is some price action that is called a “failed/fake breakout” when the fact is it wasn’t a true attempt at a breakout.

I don’t blame them because there are terms tossed around, poor information, and just an overall lack of good education in trading.

This article is going to strip away the myths about what a breakout is and hopefully you see how useful they really are.

Market Change Or Staying The Same

The important thing to know is what a breakout isn’t:

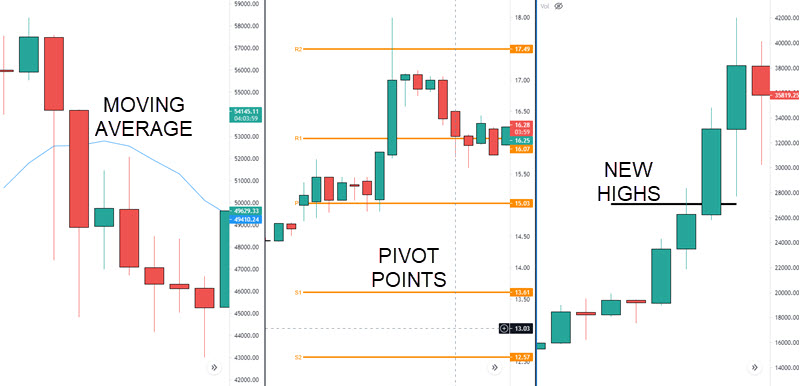

- It’s isn’t price crossing a moving average

- It isn’t the break of a mathematically calculated pivot point

- It isn’t price continuing the move

That’s not to say that you won’t ever see any moves through these types of technical features exhibit breakout behavior – but often it’ll be that they coincide with structural features when they do.

Breaks from a structural aspect are where price moves through an area which has already been tested and previously moved away from. They’re generally more significant when the move away from the tested area is clean and fast – obvious.

The reason for this is that it indicates a greater level of change when the break does happen – something new is happening – and really this is what breakouts are all about.

Terminology does make a difference and often times can be the basis for any confusion.

- A level can be taken out

- A market can undergo a behavioral change.

It’s really the last one that I see as what is typically defined as a “breakout”.

A level being taken out might only mean a continuation of the same behavior – see the “new highs” picture above. Market is just moving up.

Of course this is still relevant to a trader, but it hardly constitutes a “breakout” if the market is continuing to do what it’s been doing already.

However, if you think about a change in behavior then you can see that the market is breaking away. Typically this is when a market goes from some type of trading range and the change from range to a trend.

It can happen at a specific price level or it can happen at a structural reference point such as a trendline for example. The trend line is a reference point, not where price is actually breaking from.

Riding The Wave Of The Higher Timeframe

What about a pullback and then the continuation? Is price not breakout out of the new high (or low)?

Not really.

Once the market has reversed, it is continuing the trend direction.

But….

if you were to look down at a smaller time frame, you will see patterns that have broken out during the higher time frame continuation.

But the goal isn’t to try to capitalize on what the smaller timeframes are doing – it’s to ride the wave of the higher timeframe.

The reason for this should be clear.

It’s because directional trading in a timeframe that’s higher than the one you execute in will carry the market in your timeframe.

The higher the timeframe, the bigger the moves.

Does that make sense?

Who moves the market? Not your individual retail trader and even when we add all the retail traders together, there isn’t, depending on the stock, enough to push the market.

The biggest players such as banks and funds, have to look at a higher timeframe. If they didn’t, how would they be able to execute the sorts of volume that they do?

They are looking to execute 1000’s and 10000’s of contracts so to get in and out in the same area would be very difficult in such a short space of time. Every time they bought on a 5 minute chart would send the price flying causing them to buy at higher prices.

If they are unloading positions, imagine dropping 1000’s of contracts on a 5 minute. The result would be horrendous for them.

Recognizing where changes might occur in a higher timeframe is therefore likely to be able to carry your trades if you manage them well.

What Is A True Change In Behavior?

You have to consider what constitutes an actual change in behavior as markets are elastic to a greater or lesser extent.

In terms of a break at a specific price level or an opening range breakout, a market moving through the level does NOT automatically confirm this.

This can signify:

- a break

- an extension

- a breach

A Break

Price moves beyond an area and continues in that direction. Often but not always, a breakout is accompanied by an immediate retest of the close to or at the break price.

When this retest hold, this is where losing positions are covered and new positions are initiated, propelling the market further in the direction of the break.

An Extension

This is where price clears the level by what would be considered a reasonable amount for the product and timeframe you’re tracking, only to reverse back and continue with the action that was defining it before the attempted break.

This is can also be described as a broadening formation and an outside bar on a higher time frame.

A Breach

This similar to an extension in that the range does extend. However, price doesn’t extend far enough to warrant the sort of behavior seen on a retest of the break price.

There’s far less likely to be “pullback” type activity whereby traders are covering or initiating.

There’s not enough “room” between the extreme and the initial break price for this to happen. On a lower time frame, you’d just see a cluster of candles in this zone.

So What Is A Breakout?

Having a concrete definition of a breakout is important especially if a range trading breakout strategy is something you are considering.

A breakout is: a shift in energy and type of movement that causes a real behavioral change.

recognizing when and where these shifts are most likely to happen and knowing the types of action that are likely to be seen when these shifts are taking place can really help you to capitalize on potentially excellent opportunities. So take the time to consider these underlying principles and gain a better understanding of breakouts.