- December 5, 2018

- Posted by: Mark S

- Categories: Day Trading, Futures Trading, Trading Article, Trading Tutorials

Day trading futures attracts many types of people that share one thing in common: they want to be successful at day trading.

When the drive to succeed is strong and armed with a winning trading strategy, why do so many fail? What is the difference between the traders that succeed and those that don’t? There is no one answer, but there a number of elements that work against us as traders including:

Emotions: Failure to learn to control emotion when faced with losses, gains, luck and indecision, which leads to poor decision making.

Timing: Market timing is a factor you must master to become a successful trader. This is where the majority of traders fall by the wayside.

Capital: Under capitalization or external pressure to make money. In this do or die situation traders will often feel that the market must produce ‘regular’ and ‘consistent’ profits for them or they’ll be put into a financial bind. This introduces trade psychology issues and sets a trader up for failure.

Seeking the Golden System: Failure to stick to one trading system. Most traders typically take a few losses and then they start trying to change things, tweak things, and then ultimately find something else. They jump from one system to the next without ever really learning the system’s rules and methodology. They think they can find a no-fail trading system right away, before they give the futures day trading system they are using, a real trial. The problem with this is there are no “no-fail” trade systems and unless you truly learn the system you’ll never find success.

Now, how many of these have wreaked havoc in your trading? Personally, I’m probably guilty of making all of these mistakes at one point or another.

So, let’s focus on how we can take day trading futures strategies that have an edge, avoid these issues, and come up with a plan and strategy to help develop into a successful Futures Day Trader.

Winning At Day Trading Futures Playbook

You may have heard some of this before, but maybe this time it will sink in. Go ahead, tell yourself “this time I will apply what I hear and learn.” Why do you often read the same things over again? Because there is no magic secret to winning at futures trading. Nobody is hiding the pot of gold from you.

Let’s get started

Market To Day Trade

First, pick a market that you like or are familiar with. Keep in mind it should be one that suits your trade style. You need to make sure you have enough capital to trade that market as well.

If you have a $5,000 account you don’t want to start trading the ES or crude Oil futures since they are beyond 2% risk per trade on that size of an account. The NQ or Dow has smaller risk per point, so you and your trading account can handle a few losses without putting you on that emotional roller coaster.

Your Trading Plan

Now that you have picked a market, you must create a plan. If you don’t want to create a plan from scratch, there are several resources through NetPicks to help you. All of our day trading systems come with complete trading plans so most of the hard work is done for you.

You will need to test this trade plan yourself, but some of the work can be eliminated if you choose to go with something you know works for others. It’s best to backrest the plan for at least 6 months.

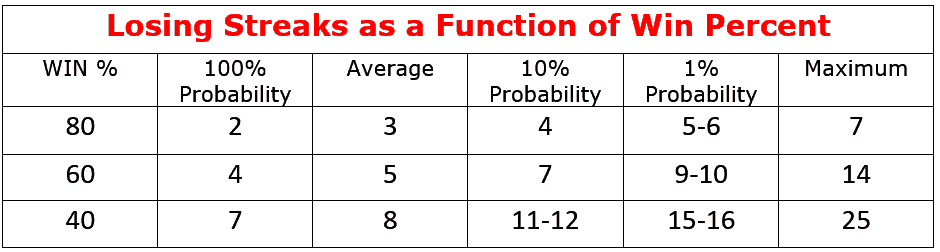

Backtesting, while not flawless, will give you anticipated results, so you know what to expect when you start to trade. It is important to know, how many wins and losses in a row your market usually gives you, so that you can be prepared mentally and emotionally to trade it.

Learn To Manage Your Day Trading Positions

Learn how to manage your trades on the platform you will be trading live. This way you can make certain tweaks, such as perfecting your trailing stop.

Remember, trade your plan, and don’t deviate from it. If you can execute 25 trades in a row with no errors then you may be ready to trade live.

Notice I said 25 trades with no errors.

I didn’t say 25 trades without losses.

You will have losses. They are a part of trading. Expect them and get used to them. This will build your confidence, strengthen your emotions and show you that the system you have works.

You can see from just these 3 steps, I have covered all of the issues above.

Live Trading – Put Your Trading Prep To The Test

Finally, it is time to trade the plan in the live market. This will give you the feel of the market. You’ll see how fast it moves and how it responds to news.

You will make mistakes, but don’t let them stop you.

Learn from each one.

Using a trading journal after each trade you can look at your results and emotions as you were trading.

Did you skip a trade because you did not feel good about it or that you expected the market to go the other way? You can skip a trade if it falls into the parameters of a filter in your trade plan, but if it doesn’t you know moving forward that is an issue you’ll need to work on.

If you find yourself making too many mistakes, then stop trading and reevaluate what you are doing wrong and why.

Quick Breakdown on Becoming a Successful Futures Day Trader

Having read the steps you can take to become successful at day trading, the following point form version may be something you should write down:

Have a plan, back test the market and then practice till you have it down cold.

Use that plan and back test data to help get your emotions and psyche under control. If you know what to expect from your testing, the actual trading will be easy and much less emotional.

Keep your risk low and don’t use too much margin. This will keep you in the game. You’ll be able to take the next trade after a few losses to come back positive or at least close to it.

Test the system and know the win percentage. Prove to yourself that it works before risking a dime.

It is not easy, but the steps are simple. You have to commit and in doing so, maybe one day successful futures day trader may be what you call yourself.

2 Comments

Comments are closed.

Do u offer any info or trading as a Swing Trader? Such as a trading plan, or the pros and cons vs. Day Trading. Just asking

Hi Don. I wrote up an article to help traders decide which way they wanted to approach the market. You can read that here: https://www.netpicks.com/swing-trading-vs-day-trading/

If you are considering swing trading and looking for a system as well as proven trading plans, please check out our Dynamic Swing Trader system. Send an email to support@netpicks.com and ask for more information.

Thanks for the comment