- June 9, 2015

- Posted by: Shane Daly

- Category: Trading Article

Gym owners love the beginning of every year when those with “get in shape” resolutions come knocking at their membership desks.

For a while, the gym is packed with new and longer term members and it can get frustrating for those who have made training a lifestyle.

The good thing is that they know it is only a couple of months before many of the new members just stop coming.

The new members start with good intentions.

They have become educated on different training methods and have laid out a plan to alter their eating habits that are congruent to their goals.

Some obtain the services of a personal trainer and of course we can’t forget the small fortune they spend on workout clothes.

The majority soon realize that the promise of “easy washboard abs” in 30 days is a myth and that it requires dedication and effort to get any results. The desire to get in shape and the actual results many obtain are separated by a huge margin.

In the end, the majority will go back to their old habits and every year will gain about an extra 3-5% of weight.

They knew what to do to reach their goal but

failed to act on it in a consistent manner.

They had behavior issues.

Your Trading Behavior

Looking at trading, we can see a lot of resemblance to those who give up at the gym and those that blow up their trading accounts.

New traders flock to forums, course, and often times learn some important trading concepts that may give them a slight edge in the markets. A slight edge is all you need to make money.

They sit in webinars and buy trading systems that have proven themselves historically and in the current market environment.

Trading platforms are researched as are brokers and each new trader settles with what fits their budget.

After learning their chosen trading method, understand risk, position sizing, and have designed a trade plan, they set forth on their trading journey determined to make their mark.

In the end, the majority of new traders

close their accounts and move on.

Most of them had trading behavior issues.

Is it fair to say that much of your success in trading has to do with behavior? I think it is.

Your Trading System

However you approach trading, you have a system or method that you have tested and has shown to have a small edge in the market. Every variable is accounted for and it is the sum of all the parts that makes the system or method a successful one.

The problem starts when you start tinkering with things without testing the change.

Netpicks has trading systems that have been fully tested not only by the developers, but also by those who purchase them. All systems come with trade plans that are only released once they pass testing using past data plus forward testing in live markets.

Your entries, stops, and targets are laid out on the chart and these are calculated from the current action of the market. The trading plans set forth times to trade and when adjustments are required just to name a few items.

Look at this chart.

You can see the system printed a trade setup that triggered and went to target. What if you decided that you were going long right into potential resistance levels as I have marked (not part of the system) and you have decided to skip the trade?

What if you continued to add/subtract variables to/from the system that were based on theory and never tested by you?

Your behavior while trading has taken the statistical edge from the system and you are no longer trading the original system.

The system clearly worked…..but your behavior caused you to miss an easy trade and as Murphy’s Law would have it, perhaps a string of losses is around the corner.

Test your system. Trade your system and the plan you’ve laid out.

Increased Position Sizing

Perhaps you just came off of a string of losses. Maybe you skipped too many trades that turned out to be winners.

Whatever the reason is, you choose to increase your position size to an amount that a handful of losses can severely damage your trading account.

Greed is real and it does seem simple enough to add on a few contracts. Even worse, your behavior is rewarded by a large win so you decide to continue to use a position sizing that won’t withstand a run of losses.

Nobody can tell you what to risk as everyone has a different risk tolerance. Every system is different as well.

You have to account for the probability of a string of losses and what percentage amount per trade will have you weather the storm.

If you are seat of the pants with risk, your behavior of not following appropriate risk allocation will take you out of business.

Letting Losing Trades Run

Virtually every trading system has a point where the trade is no longer valid and a stop out takes place.

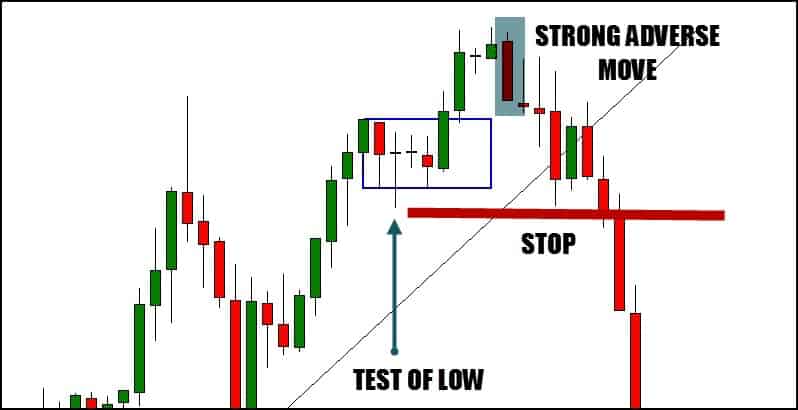

This trading chart shows:

- Uptrend

- Consolidation

- Test of low = Entry

Your system says to place your stop under where the test failed. Your system also says that after a break out, the pullback is fine unless the move back is strong. If strong, you exit.

You decide that the the uptrend is strong and price did move quickly away after the break out, so you’d ignore the strong pullback. Problem now is price is back into your entry and close to your stop but since you are convinced of the move, you pull your stop.

Price breaks down and your loss accumulates. If your smart, you exit. If you think the market is going to come back on a retrace, I can tell you that in this case it never does. Your loss becomes huge.

What makes this worse is if you also increased position sizing on this trade!

What You DO Matters In Trading

You don’t have to be the smartest on the block. You can be average, follow a proven method and plan, and find success.

On the other side, you can be the brightest and better capitalized but if your behavior is not conducive to good trading practices, you will end up on the sidelines.

While I don’t think 100% of trading success or failure is behavior related, it is a huge piece of the trading success pie. It may not always be easy to exhibit trading behavior that is on the side of a winner, but it certainly is something to strive to perfect.

In doing so, you put the odds on your side.