- November 2, 2021

- Posted by: CoachShane

- Category: Trading Article

Traders will obsess over their trade entry and profit target but won’t give a second thought to where they will place their stop loss level.

One huge issue is that many traders will place their stop in a location where the trade is still valid because it means they can have a larger position size.

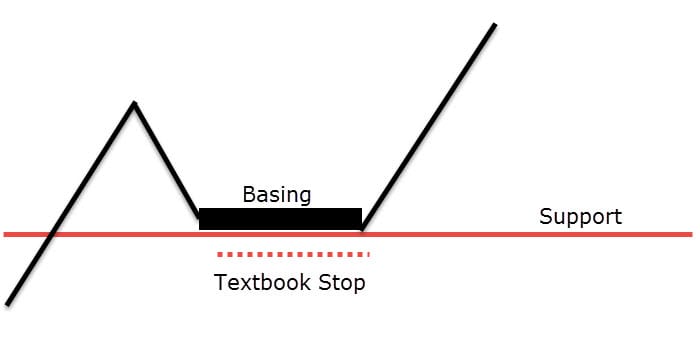

You probably recognize this type of protective stop loss:

Textbooks will tell you to place your stop loss right under a support level because if support breaks, your trade is no longer valid.

It will also allow you to use a higher position size which to most traders is something they support because they are low on trading capital.

The problem is that this protective stop ignores basic fundamentals of how markets operate and how price moves.

Breaks Don’t Always Invalidate Your Trade

In the example long position example above, price came down to support, formed a trading range above support and then took off to the upside. It’s a perfect example of a continuation play but rarely do we see such clean levels in the real market.

The market is not orderly and there is a lot of “noise” in the market that you must account for.

When looking at obvious levels for your stop loss order, you should be expecting that attention will be paid to it by many traders especially those who can really move the market.

Novice traders (and more experienced as well) will use these textbook locations and a cluster of stops will be sitting ripe for the pickings.

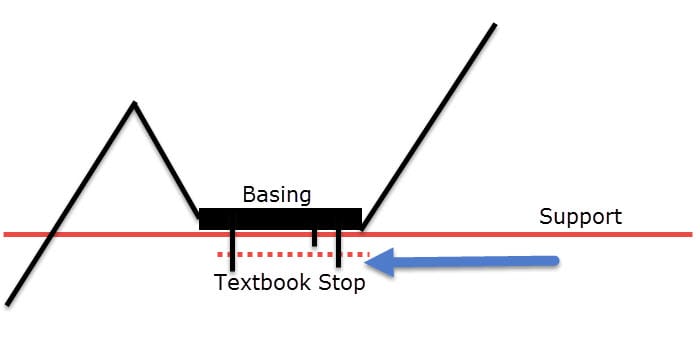

This is what a more accurate representation of these zones will look like:

What occurs is new swing lows are put in clearing out of stops sitting right below support.

How often has that happened to you?

Think for a moment what happens at these levels:

- Traders positioned long are taken out and their stops (sell stops) get triggered

- Astute traders buy these flushes below support gaining a positions at a favorable price

- Traders still holding longs get the benefit of stopped out traders buying back in which propels their trade into profits.

This is the natural evolution of price and as a trader, you should seek to avoid these flushes. Consider placing your stop loss in an area out of the way of the natural movements and volatility of price.

Using an area of support or resistance is a decent method of placing your sell order to exit your trade.

Just ensure to give yourself some breathing room so you are not getting out as others are getting in.

From swing traders to day traders, these stop loss placements suit any type of trader. Use an automatic order upon trade entry so you do not forget the most important trade exit in your plan.

Use A Moving Average Stop Loss

While not the best way to set a stop loss, using a moving average is a disciplined way to ensure you actually set one.

No, they are not “dynamic support and resistance” regardless of how many times you hear it.

It is just an average of the closing prices.

As the range of closing prices gets smaller due to lower volatility, the average will catch up to price.

These will, depending on the period used, need to be used during a trending market or at least when your entry is above the average.

The blue line is a 9 EMA and the red line is a 20 EMA. Assuming you entered long positions on the break of the high of the candle with the arrows, you would use the price of the average at the setup candlestick minus some breathing room.

The candlestick with the green dot, you could only use the 20 period EMA and even that would be too tight.

As price begins to trend, it pulls further away from the moving averages giving your trade a large stop loss.

When the trend matures, you may decide to use the closer moving average as you expect a reversal could be coming.

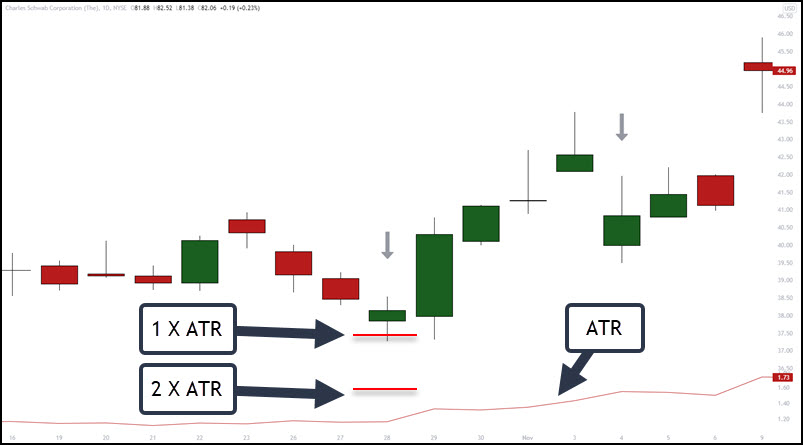

Average True Range Stop

Average true range is another objective and viable stop loss method.

I think it’s more objective than the previous method but you will still have to determine where you project the range from after the ATR has been calculated.

You just have to choose what multiple of the ATR you will use.

In this example, the ATR of 14 periods is calculated.

If this was a trade entry location, you would then subtract the ATR from the high of the candle to give you a 1 X ATR stop loss area.

Example: High price is $35.00. ATR reads $2.00. 35 – 2 = $33.00 stop loss price.

What if you entered at the close of the candle and not the break of the high?

Consider we are using ATR, the entire range of the candle. It includes the high and low and not your entry price.

For simplicity sake, just use the high or low of the candle you enter on.

For example –

- Trade entry is at the close of the candle

- ATR stop loss is calculated from the high price of entry candle

The ATR is a consistent and effective strategy that uses the movement of recent price volatility. It is my favorite stop-loss placement techniques.

Low Risk Stop Loss?

You’ve probably heard the following: “This is a low risk trading setup”.

It is a meaningless statement.

There is simply risk.

The only way a trade can be “low risk” is if you are using a smaller risk percentage than you usually do.

If you are jumping around with the risk percentages you are using, you are breaking one of the main rules of trading. I personally would not use a different risk percentage unless it was part of the trade plan for a particular setup.

For example, trading a failure test of highs may have an lower initial risk because I am expecting there will be another failure test before the trade gets going.

It is certainly not a low risk trade though.

The bottom line is that these two ways of setting your stop loss are mostly objective, keep you out of the noise and more importantly, they respect the market conditions you are trading in.