- July 21, 2019

- Posted by: NetPicks

- Category: Trading Article

Trading is a game full of risks.

Every trader knows that over time they will have some winning trades and some losing trades.

However, just because a trader is aware of the risks in what they’re doing, does that mean that they fully embrace the risks associated and accept a negative outcome?

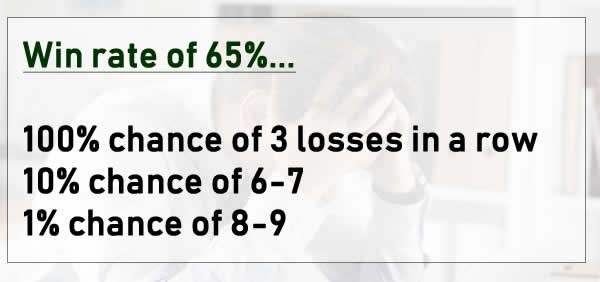

A trader will have to take losses as part of the business and sometimes they will experience multiple back-to-back losses whether they like it or not. They may have even worked out what they believe the chances are of a win or a loss.

But the trouble is that when most are sizing up a trade, they’re already counting the ticks they’ll be adding to their account.

Losses? “Not Me”

I’d argue that for some, taking a trade that may lose is almost inconceivable in the moments before taking the trade. Taking a loss isn’t something which is necessarily a bad thing, but when you’re expecting/hoping/praying for a win consciously or not, a loss can be a psychologically wounding event.

A loss can turn into an action defining event where you carry that loss into the next trade you may take.

But the trouble is that from the expecting/hoping/praying mindset, it’s a virtually impossible consequence to avoid and you might just be fighting a losing battle.

When a few losses have stacked up and you feel yourself getting beat up, another change begins to take place.

You start to fear what the market might do to you.

This is where many of the psychological issues traders report stem from. The fear and avoidance tactics it can create should not be underestimated. For example, you wouldn’t want to get caught again by taking a certain type of trade which has clearly stopped working, so you pass the next opportunity up.

But wait, what’s this? It worked this time!! “I’m gonna take the trade next time it sets up” you say to yourself.

So you take it and BAM, you lose again. The market must know you took the trade that time!

It’s not just the losses that cause issues either.

Think about exiting a position for a winning trade. You try to run it and you get caught, perhaps even taking a loss. So the next time, you exit the trade ‘sensibly’ and the market immediately moves strongly in your direction.

It really can be a maddening experience!

Embrace Risk To Make Profit

Until you learn to embrace the risk involved in finding out whether the market will provide you with a positive or a negative outcome on any particular trade, you may well encounter some of these problems.

To understand risk is one thing, to embrace it is another.

But how do you do this?

Most think they already do.

Embracing risk is seeking defined opportunities which give you the opportunity to make money more than you lose.

To be able to embrace risk, here are a few things you’ll need to do:-

- You should have at least a basic understanding of how markets work – if you don’t how will you be able to define opportunity?

- You need to have a reasonable amount of capital – if your next trade could wipe out 10% of your account, there’s little chance of remaining objective when one string of losing trades could take you out of the game completely.

- You need to define your strategy in such a way as you’re able to execute it as objectively and consistently as possible – it’s very difficult to do this if you don’t have a clear reason to take each trade.

- You need to have confidence in your own ability to identify setups and execute the strategy – if you’re unable to identify and execute a strategy consistently in real-time, your results will be less consistent than your testing suggests.

- You need to test your strategy, understand it and identify what the maximum normal level of draw down might be.

- You must assess and account for extended draw downs and to some degree normalize your risk per trade. You must have confidence in the performance of your strategy over time.

- You must accept that you have no way of knowing whether the next trade you take will be a win or a loss.

Accepting risk means being comfortable with either outcome having already understood the probabilities.

Think Groups Of Trades – Not Individual Trades

Understanding that you can’t know how each trade will turn out before you’ve exited it just goes to prove that the outcome, win or loss, is not what matters for an individual trade.

The p/l of any particular trade should never matter that much and if it does, there’s something wrong in your approach to the markets. Mindset, for many, is the missing link.

What matters about specific trades is whether you were able to execute your plan with a high degree of accuracy and impartiality. If over time you’re still losing, perhaps it’s your plan which needs to be readdressed.

Once you have everything in the list nailed down, the only way forward is to find appropriate opportunities to execute your strategy and find out whether on that occasion, the market will hand you a winning or a losing trade.

When you approach the market with the mindset of execution when your rules set up an opportunity, you will truly embrace risk.