Swing Trading

-

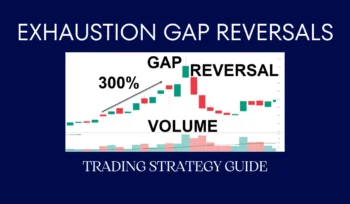

Exhaustion Gap Trading Strategy For Reversals

April 9, 2024 -

Smarter Way to Buy Crypto: Intelligent Dollar Cost Averaging

November 5, 2023 -

Finding Stocks For Swing Trading

October 26, 2023 -

Trading Daily Price Action Setups

October 5, 2023