- August 25, 2021

- Posted by: CoachShane

- Category: Trading Article

There are a few trading order types you should know and the one you use can actually make a difference in the outcome of a trade.

With some order types, you may not even get into a trade.

Certain orders, depending on when used, can cause your position to suffer from slippage.

This essentially means that your trading order will get filled at a price different than what you expected.

For the most part, the slippage is small, if any, in normal market conditions. It really all depends on what happens between pressing the order button and the order getting filled.

The bottom line with trade entry orders is using one that suits your needs.

Trade Order Entry Types

Let’s discuss the 3 main types of orders you will use when entering and exiting your trades.

What Is A Market Order?

This is the most basic way of entering a trade and is a guaranteed entry.

When you click the buy/sell/close button on your platform, you are requesting a transaction at the best available market price.

The issue with this is that the bid/ask price is constantly fluctuating.

If you see a price of 1.3400 for example and you want to enter a buy by pressing “Buy”, by the time the order occurs, price may have gone down or up.

If price goes up, you bought more expensive and with down, you got a cheaper price.

This is for traders who want a guaranteed position or quick execution during market hours.

What Is A Limit Order Type?

These orders are only filled when price reaches the price you have chosen to enter the market at.

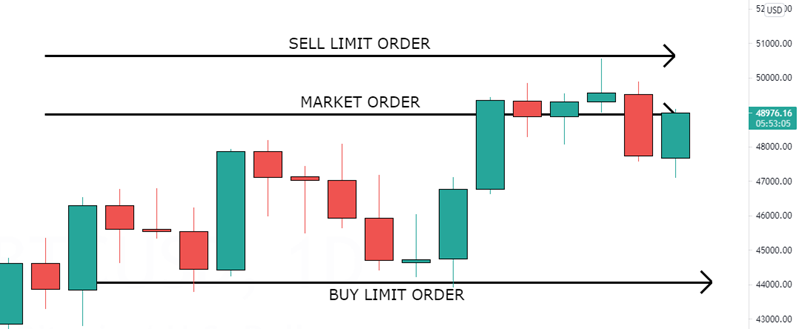

- Buy Limit: Once you set these in your broker platform, you have set instructions to buy if the market reaches your price. Limit buys are always set BELOW the current market price. In this example, you would buy Bitcoin at the buy limit order of $44060.76

- Sell Limit: The exact opposite of buy limit. Your order to enter the market short is set ABOVE current price. Traders looking to sell about current price would set a sell limit order of $50631.87

- Market Order: Traders who love the current price would enter a market order to buy now at $48932.74

Keep in mind that when trading stocks, limit orders are filled on a first in first out basis.

You may still not get filled at your requested price if there are many orders ahead of you that exceed the supply of stock at that price. This is one of the reasons Netpicks is a supporter of Options trading.

Learn About Stop Orders

These are an interesting type of order and they do have a unique quality about them and that is they combine the attributes of both limit and market orders.

They sit in the market waiting for price but when executed, they act as market orders and suffer from the same issues those orders have.

Think of these orders as the opposite of the limit orders. For example, if you choose to enter a market long, setting a buy stop order has you setting an order ABOVE the current price unlike limits where you would set it below price.

Let’s use the same chart and look at stop orders.

- Buy Stop: We would use this order to enter a trade once price breaks this level. Think of terms of trading breakouts or trend continuation trades when using this order type

- Market Order: Same as before

- Sell Stop: Most often used as a stop loss order below current price. Once this price is hit, the order is converted to a market order and you get the best available price.

Main Difference Between Stop and Limit Orders

Using limit orders, your trade will only be filled at the requested price or better.

The stop order will be filled at the best possible price which may be much worse than you expected.

Stop orders can be hazardous to your trading account when gaps come into play.

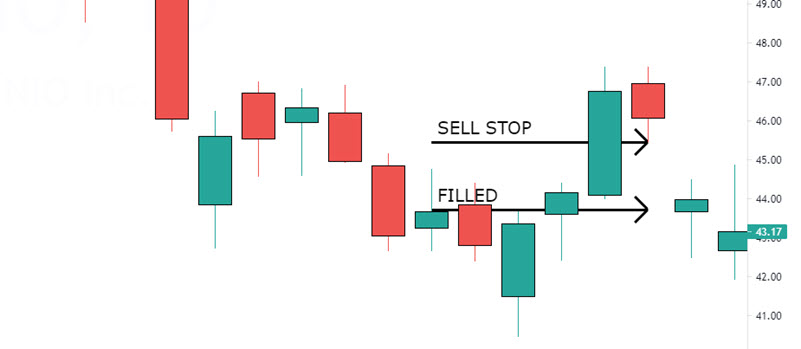

Let’s look at a sell stop to enter the market.

Here we had a sell stop order at $45.45 but with the gap down and getting a market order fill, $43.72 would have been roughly what you would have been filled at.

On the flip side, if you used a sell limit order to exit a trade and price gaps up over that price, you get a higher filled order and more profit.

In Conclusion

Order types, market conditions, and volume of trading activity all have an effect on your trade execution.

It is vital that every trader understand the trade order types that are available, the positive and negative of each, and apply the right ones according to your trading goals.