- November 5, 2015

- Posted by: CoachShane

- Categories: Basic Trading Strategies, Trading Article

The failure test chart pattern is one of my favorite patterns to use.

This is a simple price action trade setup that appears in virtually every single time frame.

The higher the time frame, the longer you may want to consider holding the position.

Simple Trade Setup Details

You may have read in one of the posts that a trade equals a setup plus a trigger. You may have a setup but it does not always equal a trading trigger.

By having a trigger in your trade setup, it will keep you from emotionally entering a trade

There are many names you may want to use to describe this trade. Failure test, price probe, stop run, or whatever name you want to apply to it is fine but I like to call it a failure test.

There are a few things we need to see for this trade before and during the setup.

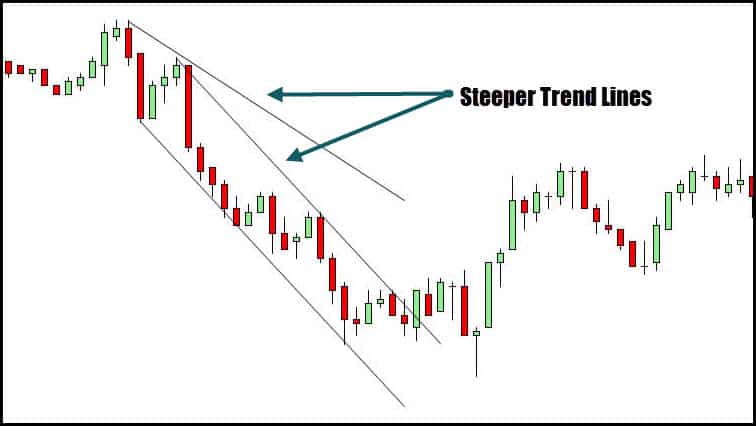

We want to see price have some sort of run to it. In this case, price had dropped almost 100 points in just under sixty minutes.

For those who like trend lines and watching the slope, this certainly had a slope that would indicate a run in price.

I had to reproduce the charts because I was not sent the actual charts that were used.

The first part of the trade setup is complete in that we have had an extended run in price. This extended run offers up the potential of a run in the opposite direction.

Sideways Price Action

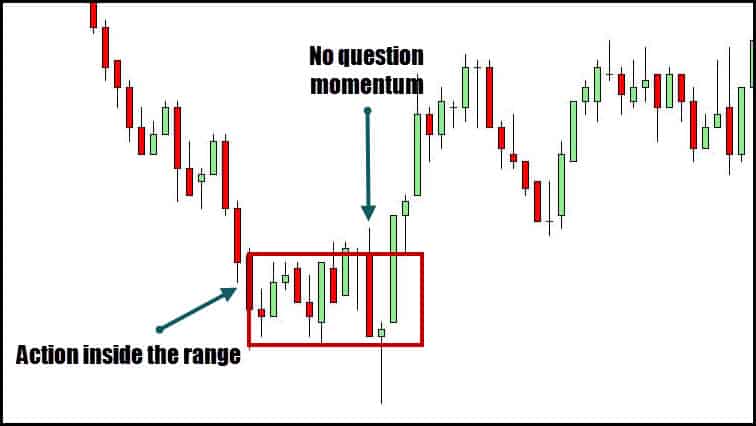

You want to look for price to start printing sideways as this is showing that some of the run is being worked off.

It’s also important because traders have noted the large move in price and many are feeling like they missed the move. You also get those that are always wanting to catch the turns and they are sitting and waiting to pounce.

You can clearly see in the second variable of this trade setup that price is ranging inside the high and low of the lowest candle of the push down in price. When the trader that emailed me saw this start to occur, she went on high alert for a possible trading opportunity.

On the right side of the range, you see price pop up through the high and slam down which some traders look at as the starting flag in a Nascar race. Traders pile in and also note that there may have been buyers that entered on the upside break trapped inside that red candle.

With the formed range, we are near the end of the setup.

Price Fails At The Lows

You now want to see price slam the low and immediately (relative to time frame) reject the new price level and race back inside the range. This trader is a stickler for “confirmation” and needs the failure to also pierce the standard setting Bollinger Band.

If that does not occur, there is no further interest.

The setup for this trade is now complete and what you need now is a trigger to get you into the position.

A quick trade setup recap:

- A strong run in price

- Ranging price action

- Break of range and immediate recovery

We still need another piece of the puzzle.

Trade Setup Plus Trigger

The trade trigger is simple and for brevity, the next chart will cover the rest of the entire trade.

A buy stop is placed just above the recovery candle with a stop at the low. There are times where the first recovery may fail (same trade on higher time frame) but we don’t know if it failed because the trend is resuming.

You can always re-enter a trade so take the stop if it occurs.

The target (1) was because this area was already tested and she felt it could break. There was a Bollinger pierce (remember what her confirmation was for the long) and in tandem with the resistance level, the exit was done.

Since there was a strong move to the upside, being on alert for another leg was almost routine.

At #2, price pulled back to the top of the range that started this entire move and combined with the basic Bollinger trade, a long was taken.

The target was a wait and see at #3. Price did not extend and once it pulled back to the mid-line, the trade was ended.

You can see that simple has always and will always work in trading. Getting caught up in the complex and “system hopping” is not a great use of your trading education time.